For most people, the State Pension is an important part of their income in retirement. But our research shows that, in 2023, only half of pensioners who get the new State Pension (those who claim their State Pension from April 2016), got the full amount1. Many people get less than this.

The amount you get is based on the National Insurance you’ve paid or been credited with, and if you have gaps in your National Insurance record, it’s one reason why you may not get the full amount.

You may be able to fill in any gaps in your National Insurance record over the last six years. The starting point for finding out how much State Pension you’re on track to receive, and whether you have any gaps in your National Insurance record, is to get a copy of your State Pension forecast.

In this article, we’ll cover:

- What is the State Pension?

- What is the State Pension forecast?

- How many years of National Insurance contributions do you need for a full State Pension?

- How to check your State Pension forecast

- How to make voluntary National Insurance contributions

- How much do voluntary National Insurance contributions cost?

- Who shouldn’t make voluntary National Insurance contributions

What is the State Pension?

The State Pension is a regular payment from the government that most people are able to get once they reach State Pension age. This isn’t the same as the age you can start to take money from a private pension, like a workplace pension, or the age you retire at , but is an age, set by the government, which is the earliest that you can claim your State Pension. Currently you must be aged 66 to claim the State Pension, but this age has changed in the past (it used to be 60 for women and 65 for men) and is due to go up to 67 by April 2028.

You build up your entitlement to the State Pension by paying National Insurance contributions, perhaps because you’re employed or work for yourself, or by receiving National Insurance credits. National Insurance credits count towards your State Pension in the same way as paying National Insurance, but you get given these as a result of receiving certain state benefits.

The new State Pension is paid to people who reach state pension age from 6 April 2016 (this means men born on or after 6 April 1951 and women born on or after 6 April 1953). If you reached State Pension age before then, you would have been entitled to the basic State Pension.

To get the full new State Pension, you need 35 years of National Insurance or credits. The full new State Pension is £230.25 a week in the tax year 2025-26. This amount generally rises every year.

What is the State Pension Forecast?

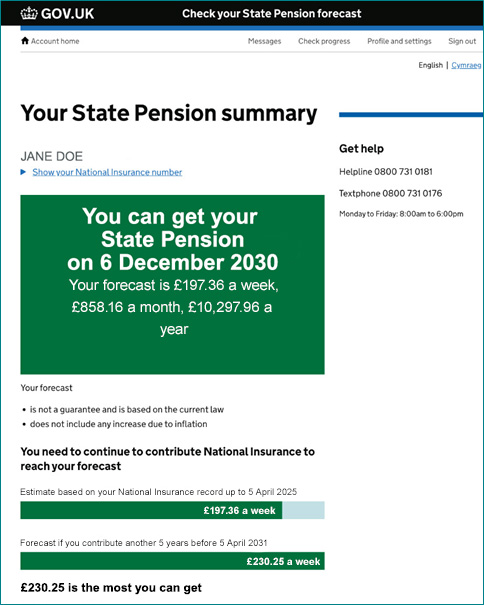

The State Pension forecast tells you how much State Pension entitlement you’ve built up so far, what you’re on track to get when you reach State Pension age and when you’re able to claim your State Pension.

There are different ways you can check your State Pension forecast, but the quickest way to do this is to go onto the Gov.uk website or to use the HM Revenue and Customs app, which you can download onto your mobile phone.

What the State Pension forecast will show you

The State Pension forecast will show you, in weekly, monthly and annual amounts, how much State Pension you have built up so far by paying National Insurance contributions or by receiving National Insurance credits.

It will also tell you when you can claim your State Pension and how much you are likely to get. This amount is not guaranteed, because, for example, it assumes that you continue to pay National Insurance until you reach State Pension age. If you don’t do this, you may receive a lower State Pension amount. The age you can get your State Pension at isn’t guaranteed either, as the government may increase it in the future.

Who can use the State Pension forecast tool

Anyone who lives in the UK and who is below State Pension age can use the online State Pension forecast tool. If you live abroad and have already set up a Government Gateway account, you can also get your State Pension forecast online from Gov.uk. However, if you don't already have a Government Gateway account and you live abroad, you may not be able to use register for one for security reasons. However, you cannot use it if you are already receiving your State Pension or if you’re old enough to claim it, but you’ve delayed doing that.

How is it calculated?

The way the amount of State Pension you’re entitled to is calculated is not necessarily straightforward. That’s because a new State Pension system was introduced in April 2016. Most people currently working will have built up some of their State Pension entitlement under the old basic State Pension system and some under the new State Pension system.

When the new State Pension system was introduced, in April 2016, the Department for Work and Pensions took a ‘snapshot’ of the State Pension you’d built up at that point and compared it to what you would have built up under the new State Pension system. It then gave you the higher of the two amounts as a ‘foundation’ or ‘starting’ amount of State Pension entitlement.

Any National Insurance you’ve paid or been credited with since 6 April 2016 counts towards your State Pension under the new State Pension rules.

If you were what’s called ‘contracted out’ then you may not be on track to get the full State Pension, but there won’t necessarily be any gaps in your National Insurance record either. Contracting out meant that you and your employer paid lower National Insurance contributions but there was a promise that the occupational pension you were in had to pay a certain level of benefits. It was particularly common with public sector final salary pensions but used to be the case with some private sector pensions as well.

How many years of NI contributions do you need for a full State Pension?

Under the new State Pension system, you need to have paid or been credited with 35 years of National Insurance to be able to get the full amount of the new State Pension. You can receive National Insurance credits if, for example, you have registered for Child Benefit and your child or children are under the age of 12, or if you are claiming certain benefits.

If you have paid or been credited with less than 35 years of National Insurance, you will receive a smaller State Pension. Our research shows that only half2 of pensioners entitled to the new State Pension got the full amount in 2023, with almost 150,000 pensioners getting less than £100 a week.

The amount you get will depend on how many years of National Insurance you have paid or been credited with. However, in order to get any new State Pension, you need at least ten years of National Insurance or credits. That means if, for example, you have nine years of National Insurance, you won’t get any State Pension at all.

Under the old State Pension system, you needed 30 years of National Insurance to receive the full basic State Pension. The full basic State Pension is £176.45 a week in the tax year 2025/26.

If you are not on track to get the full new State Pension amount when you retire, you may be able to fill in the gaps in your National Insurance record, by making voluntary National Insurance contributions. Not everyone can do this, but if you can, then normally, you can only go back over the last six years and fill in any gaps.

How to check your State Pension forecast

The quickest way to check your State Pension forecast is online on the Gov.uk website or on the HM Revenue and Customs app.

If you don’t already have a Government Gateway account, then you will need to set one up if you want to check your State Pension forecast online or through the HMRC app. You’ll need to provide your email address to be able to do set up an account.

You can also check your State Pension forecast by calling the Future Pension Centre on 0800 731 0175 or by filling in a form (called BR19) and posting it to the Future Pension Centre.

You don’t need to set up a Government Gateway account if you want to get hold of your State Pension forecast over the phone or by sending off a copy of the BR19 form.

How to make voluntary National Insurance contributions

There are several steps to take if you want to make voluntary National Insurance contributions:

- Check your State Pension forecast: If you’ve already paid or been credited with enough National Insurance to get the full State Pension, then you don’t need to make voluntary National Insurance contributions.

- Check your National Insurance record: This isn’t the same as your State Pension forecast. Your National Insurance record shows whether you have paid or been credited with National Insurance, or whether you have gaps. If you check your State Pension forecast online, it includes a link to your National Insurance record.

- See if you can buy voluntary National Insurance: Not everyone with gaps in their National Insurance record can make voluntary National Insurance contributions, but you can find out by going onto the Gov.uk website or via the HMRC app. Most people will be able to use the online tool if they want to buy voluntary National Insurance contributions, including those living abroad who want to buy National Insurance for periods when they were living in the UK. But you can’t use the online tool if you are already receiving your State Pension, if you’re self-employed or if you’re currently living outside the UK and want to fill in gaps in your National Insurance record from when you were working abroad. If you fall into any of those categories, you would have to ring the Future Pension Centre on 0800 731 0175.

- Do your sums: Work out if buying voluntary National Insurance is a good use of your money. This is a personal decision. It will depend on a range of factors (which are explained below), as well as whether you have savings to pay for National Insurance and how long you are likely to live for.

- Pay for the National Insurance contributions online: If it’s right for you, you can pay for voluntary National Insurance contributions online. If you’re making voluntary National Insurance contributions, you’ll need an 18-digit number in order to make the payments. You will need to ring the National Insurance helpline on 0300 200 3500 to get this number.

How much do voluntary National Insurance contributions cost?

Voluntary National Insurance contributions cost £923 a year for tax year 2025/26, but you may pay less if you’re topping up for earlier years. You can find out about the cost of voluntary National Insurance on the Gov.uk website.

For each year of National Insurance you pay for, you’ll be entitled to an additional 1/35th of the full State Pension a year (because you need 35 years of National Insurance for a full State Pension). Using the 2025-26 full new State Pension rates, 1/35th of the new State Pension is £343.26. So, for some people, paying for voluntary National Insurance could be a good use of their money.

Who shouldn't make voluntary National Insurance contributions?

Making voluntary National Insurance contributions is not the right option for everyone. There are several situations where it may not be worth your while buying voluntary National Insurance contributions. These include:

- If you can claim National Insurance credits: You may be able to claim the National Insurance credits, such as carer’s credits or grandparent’s credits. That means you would be able to increase the amount of State Pension you get without buying voluntary National Insurance.

- If the State Pension is your only income in retirement: If you don’t have any other pension or savings, by paying for extra National Insurance contributions to top up your State Pension, you may disqualify yourself from a benefit called Pension Credit. Pension Credit tops up your income to around the same level as the maximum you can get from the new State Pension, and it means you can claim some other benefits as well. But once you’re entitled to the full State Pension, you may not be able to get Pension Credit (although there are situations where you can have a higher income and still get Pension Credit). You can read our guide to Pension Credit.

- If you’re still some years away from retiring: If you have some years to go before you’re due to retire, then paying for voluntary National Insurance may be a waste of money if you carry on working. That’s because you’ll be likely to pay National Insurance through PAYE or by being self-employed. If you’re claiming certain benefits you should get National Insurance credits and are going to continue to do so, again, paying for voluntary National Insurance contributions could be a waste of money.

- If you were contracted out: If you were contracted out (as explained earlier in this article), then you may not be on track to get the full State Pension. However, you can’t pay voluntary National Insurance contributions for the years you were contracted out because there aren’t any gaps in those years. You were still paying National Insurance – just at a lower rate (as was your employer). You may be able to increase your State Pension amount by paying National Insurance by continuing to work or by getting credits if you claim certain benefits. If you want to find out more about being contracted out, you can read more on the Gov.uk website.

Sources:

1 Royal London - Revealed: 150,000 pensioners get a State Pension of less than £100 a week

2 Royal London - Revealed: 150,000 pensioners get a State Pension of less than £100 a week

3 GOV.UK - Rates and allowances: National Insurance contributions