How it works

Tell us a few basic details

We’ll ask a few questions about your pension, how much you pay in, when you’d like to retire, and your desired lifestyle in retirement.

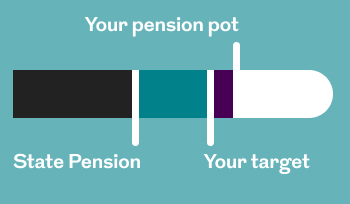

Discover your income

See how much you could get when you retire and when based on your finances. Find out if you’re on track to afford the kind of lifestyle you want.

Explore your options

Learn how changes to your retirement age and monthly pension contributions could impact your income when you retire.

The benefits of our pension calculator

-

Quick and easy to use

The calculator only takes 5 minutes to complete. In a few simple steps, we’ll tell you if you’re on track for retirement.

-

Plan for retirement

Our pension calculator considers holidays, bigger purchases, and day-to-day expenses, so you can give yourself a target income to aim for.

-

Financial factors explained

We explain things like tax, growth rate, inflation and more so you can see the how they could affect your future retirement income.

Before you use the calculator

If you already have a financial adviser, we recommend you speak to them first as this may be part of your financial plan.

You’ll need of rough idea of how much you:

- Pay into your pension each month

- Currently have saved in your pension

- Spend yearly on food, drink, clothes, and home improvements.

Important information

This calculator doesn't provide personalised advice or recommendations. What you actually get when you retire will depend on how your investments perform - this could be more or less than the amounts shown.

Find the support you need

Find a financial adviser

We strongly recommend talking about your retirement options with a professional financial adviser.

Pension Wise

Pension Wise (external site) is a government service from MoneyHelper that offers free, impartial pensions guidance.

Get in touch

Have a question or need some support? Our customer service team are here to help.