Workplace pensions: Are they working hard enough?

Against the backdrop of ongoing higher bills and costs for many, our research aims to understand employees' and retirees' perspectives on workplace pensions and stimulate discussions among providers, advisers and employers. This article covers our research in 2024. You can read our workplace pensions report for 2025 here.

Value of workplace pensions

In 2024, employees told us they highly valued workplace pensions. When asked to rank the importance of employee benefits, pensions were second only to salary, outranking flexible working and bonuses. Almost half (49%) of employees consider pensions crucial when applying for a job, especially those aged 50-69 (62%).

Multiple jobs and pensions

These days, employees often have several jobs over their careers, leading to multiple pension pots. On average, employees have had 4.5 jobs and possess around 2.4 pensions. Younger employees have more pension pots, as many started their working lives since the introduction of automatic enrolment.

Employer contributions

Most employees (64%) are satisfied with their employer’s pension contributions, although satisfaction varies by income and gender. Employer matching of contributions, where employers will pay in, pound for pound, the same as an employee does over the statutory minimum, is a significant benefit, but affordability and understanding remain barriers for some employees. Notably, only 44% of employees earning £10,000-£19,999 are satisfied with employer contributions compared to 84% of those earning over £100,000 annually.

Tips:

- Make use of employer contribution matching, where it is available, if you can afford to do this.

- Remember your old workplace pensions and make sure you keep your contact details up to date.

- Consider moving all pensions into one pot if this helps you engage with your pension. But transferring isn’t right for everyone, and if you’re unsure, then take financial advice.

How employees engage with pensions

Pension engagement

Engagement with pensions varies widely. One in six employees checks their pension weekly, yet one in eight never checks it. Mobile apps and online portals have made it easier for people to check their pensions, but more efforts are needed to boost engagement.

Pension anxiety

Some employees feel anxious and uncertain after checking their pension savings, highlighting the need for better communication, education and support to help them feel more confident about their financial future. However, over one in four employees (26%) feel confident after checking their pension savings, with a further one in five (22%) feeling motivated to save more.

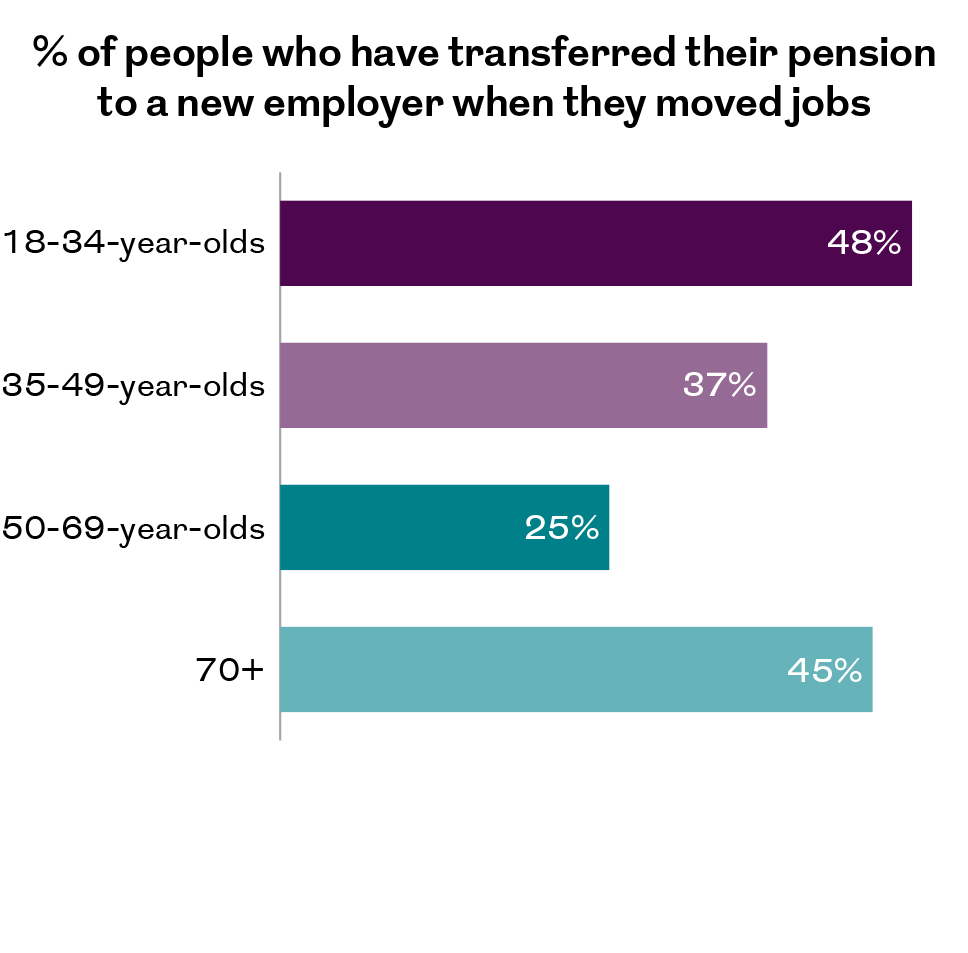

Pension transfer behaviour

Almost two in five employees who have held a number of jobs in their lifetime (39%) and who have a defined contribution pension, have transferred their pension to a different provider when moving jobs in the past. Ease of management was the main driver for people transferring their pensions.

Tips:

- Explore different ways of checking on your pension to find the method that suits you best.

- If you check your pension regularly, don’t worry if you see short-term fluctuations in value. Pensions are designed to be long-term investments.

- If checking on your pension makes you anxious, try to identify why, then find out what support is available to help you and any steps you can take to address that.

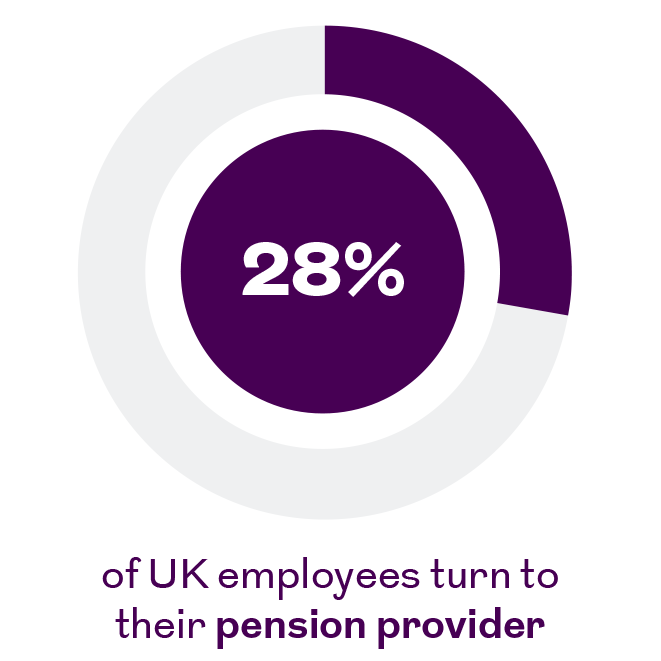

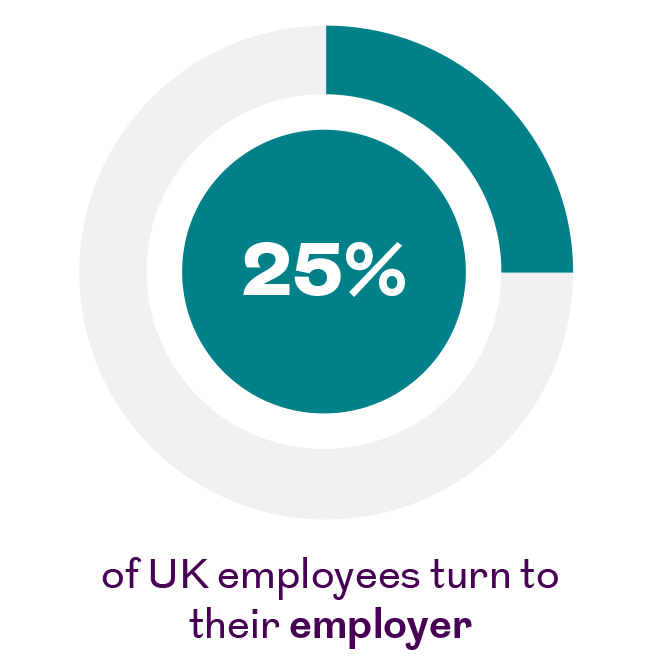

Sources of information and guidance

Employees turn to various sources for pension information. Pension providers are the top source, followed by employers and financial advisers. The reliance on pension providers increases with age, and higher earners are more likely to consult financial advisers. Interestingly, friends and family are the most relied-upon source for wider financial information, especially among younger employees.

Tips:

- Find out what guides and tools your pension provider offers to help you save for the retirement you want.

- If you’re over 50 and have a defined contribution pension, you can get a free session with Pension Wise, which is a government-backed service. It will explain your pension options at retirement.

- Speak to your employer if you don’t know what help they offer.

Retirement income expectations

Younger employees are more ambitious about their retirement income needs, estimating they need around £45,000 annually for a good standard of living. In contrast, older employees expect to need between £25,000 and £35,000. The Pension and Lifetime Savings Association's Retirement Living Standards offer a reference point for different retirement lifestyles, helping individuals set realistic expectations. And once these were used as a reference point, employees tended to say they expected to be able to live on less in retirement than in their initial answer.

Retirement age and regrets

Most employees plan to retire at 65, with younger employees aiming for 60. Almost half of those who were no longer working had retired earlier than planned, with a majority expressing no regrets about their retirement decisions. However, when those who had retired and those below retirement age were asked about wider financial regrets, almost one-third wished they had saved more for retirement or started saving earlier.

Tips:

- Take time to imagine your life in retirement – what will you do and what will it cost?

- Get hold of your State Pension forecast from DWP, if you haven’t already done so. This will tell you whether you are on track to get the full State Pension. If you aren’t, you may be able to fill in gaps in your National Insurance record.

- If you’ve already retired and are struggling to pay your bills, make sure you’re getting all the state benefits and help you are entitled to.