Reviewing your finances after the end of a relationship

A guide to reviewing your finances if you’re recently divorced or a relationship has ended

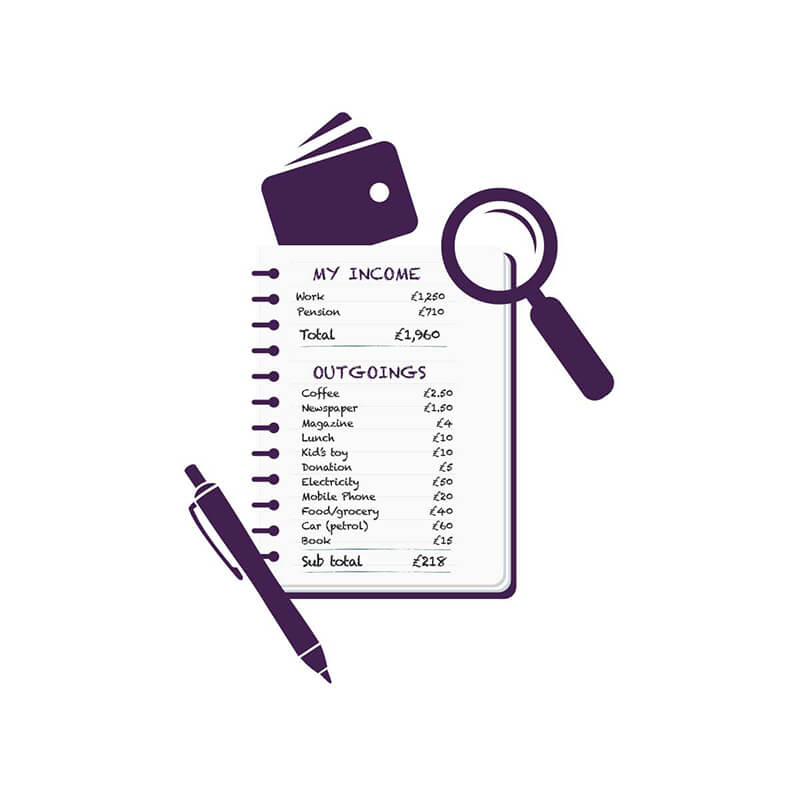

The end of a relationship means you've probably gone through a big emotional upheaval. You may have moved home and your financial circumstances are likely to have changed. A good way to assess your new financial position is to draw up a budget to see exactly what income you have coming in and what your financial commitments now are.

Your income

Start by working out your income. This could come from several sources such as your salary if you work, any pensions you receive and any maintenance payments you get.

You may also be entitled to state benefits. For example, you may be eligible for benefits if you’re on a low income, not working, sick, have children, are over State Pension age, have a disability or have caring responsibilities. You can find out what benefits you might qualify for by using one of the benefits calculators in the Where to find out more section below. You will need accurate information about your:

- income (such as from your pay slips)

- existing benefits and pensions (including paid to anyone you live with)

- savings

- outgoings (such as rent, mortgage, childcare payments)

As well as state benefits, you may also be entitled to help from your local authority with your housing costs or Council Tax. If you’re now the only adult in your household you will be entitled to the 25% single person discount on your Council Tax. If you’re on a low income or state benefits, you may be entitled to Council Tax Reduction (sometimes called Council Tax Support) which could reduce your bill by up to 100%.

There are also grants available from charitable organisations for people on a low income and other types of help such as schemes and grants to help towards your energy costs, water bills and energy efficiency measures. For details see Where to find out more.

Your expenses

Next work out your expenses. You may have moved home or be paying for a place and all the household bills on your own now rather than sharing the cost. You also may have new expenses such as for car maintenance, for example, if your former partner did this. You may need to replace certain items if these were owned by them. If you are going through a divorce then there could be legal and court expenses.

There may also be some savings. For example, you will only have your own bills to pay for now, so instead of two mobile phone contracts you might only need one now. You can stop paying for items or services that only your partner used and your food bills may be less. If you are the only adult living in your house now, you can get a discount on your council tax bill.

It’s a good idea to jot down all your expenses starting with essentials and then “nice to haves” so you can get an accurate picture of how much income you need. Some expenses will be quarterly or yearly so you need to set aside some money for these each month so you don’t get caught out with a bill you can’t pay.

If you’re not sure how much you spend on a daily basis, try keeping a spending diary for a few weeks or better still a month. A spending diary is simply a list of everything you spend down to the smallest expense such as a coffee when you’re out with a friend, treats for children or a newspaper.

By taking a close look at your financial commitments and spending, you’ll be able to see exactly how much money you need to get by and how you’re currently spending your cash. You may also see ways you can cut back if necessary or where you’re spending money unnecessarily.

For help drawing up a budget, you can try MoneyHelper's free Budget Planner.

A list of income sources totalling £1,960:

A list of outgoings with a remaining balance of £218

Cutting your bills

It’s a good idea to regularly review your household bills to make sure you’re not paying over the odds for these services. Price comparison websites can help you spot if you could make savings by changing energy providers, mobile phone contracts, broadband deals and insurance providers. There are also websites to help you compare the cost of loans, mortgages and how much you can earn on your savings. There are websites to help you save on your grocery bills.

Where to find out more

Benefit calculators:

Broadband comparison websites:

For a list of price comparison websites approved by Ofcom, the telecoms regulator see:

Budget Planner:

Council Tax discount:

Council Tax Reduction:

Check what grants you might be entitled to at:

Find out about switching supplier or energy tariff at:

Mobile phone contracts comparison sites:

For a list of price comparison websites approved by Ofcom, the telecoms regulator see:

Petrol prices app (you will need to register for this):

Water bills – how to save water and cut your bills: