-

Make sure your personal details and contact information are all up to date

-

Nominate or update your beneficiaries, so you don't leave your pension to the wrong person

-

Don't miss out on any potential extra retirement income and track down any lost pensions

-

Build your knowledge with our pension guides, to help understand what pensions are, how they work and how to get the most out of them

Check in on your pension

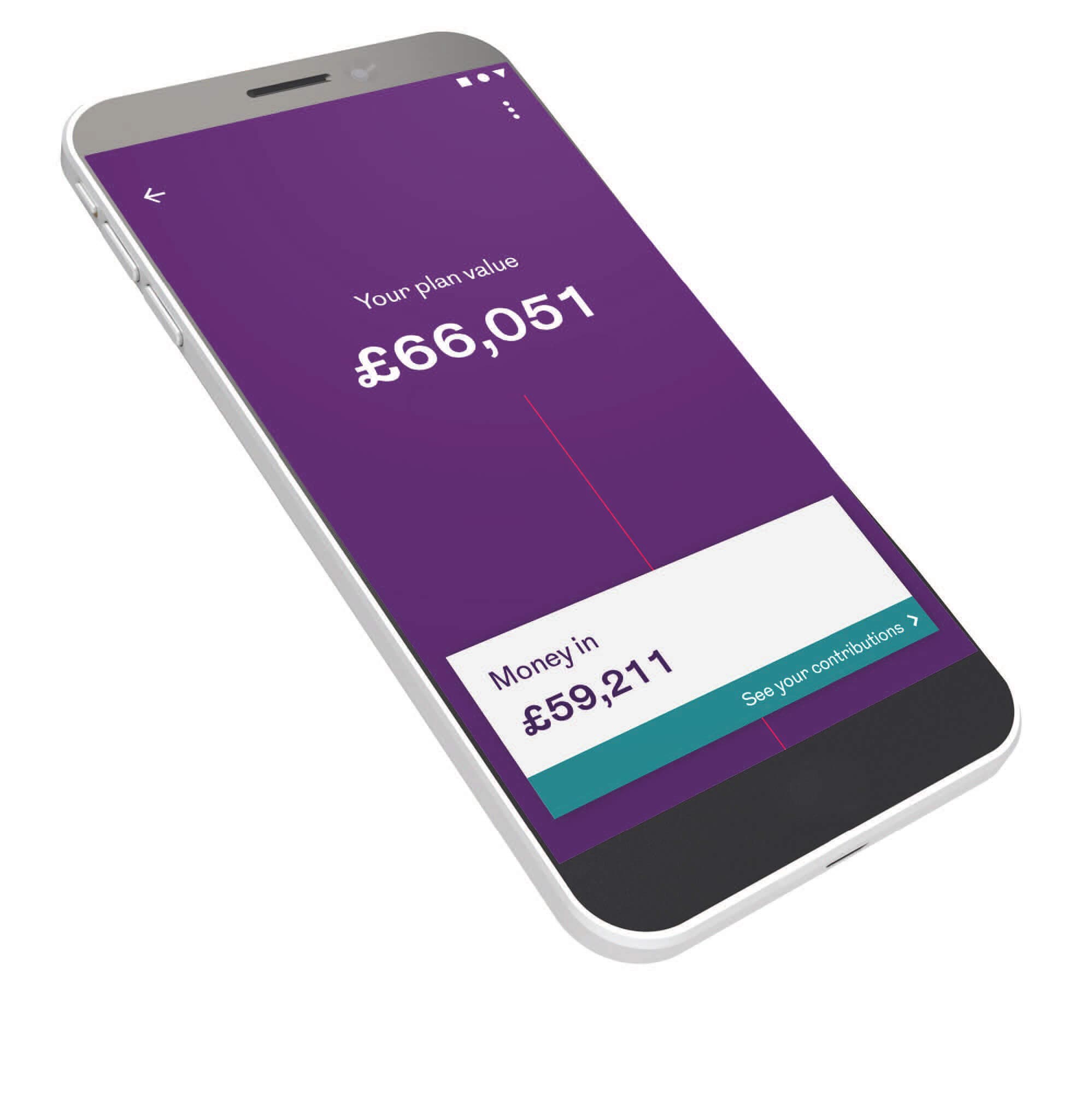

One of the easiest ways to give your Royal London pension some attention is to check it regularly using our mobile app. Available for Royal London pensions taken out since 2004 or with Scottish Life, it gives you quick and easy access to check in on your pension whenever you need.

Our 2024 Pension Awareness shows and other webinars

In September 2024, as the partner of Pension Awareness Week we took part in three live shows:

- Is it a good idea to transfer my pension? with pension expert Justin Corliss and Consumer Finance Specialist Sarah Pennells

- How to get ready for the retirement you want with pension expert Clare Moffat and Consumer Finance Specialist Sarah Pennells

- How to shrink the gender pension gap with pension expert Clare Moffat

All recordings and all our other pension webinars are available for you to catch up on now.