Recent fund changes

Our range of funds are subject to change. If you are directly affected by any changes we will write to you in advance.

Closure of RLP UK Opportunities – May 2025

Following a review of the investment options available to Royal London policyholders, we have taken the decision to close the RLP UK Opportunities. We have considered all available alternative funds in the Royal London range against a set of criteria to make sure we identified the closest possible match to the existing fund, with the outcome being that investments in this fund will switch into RLP UK Equity week commencing 26 May 2025.

What’s changing?

- RLP UK Opportunities fund will close w/c 26/05 and policyholder investment in the fund will move to the RLP UK Equity fund.

- The Annual Management Charge (AMC) will remain at 1.00%.

- The RLP UK Equity fund includes a similar range of assets and has the same geographical split with a focus on UK equities.

- The RLP UK Equity fund is also in the same ABI sector as the RLP UK Opportunities fund - the ABI UK All Companies sector.

About the funds

Both the RLP UK Opportunities fund and the RLP UK Equity fund have a similar investable asset range and use the same geographical benchmark.

| Existing | New | |

| Fund name | RLP UK Opportunities | RLP UK Equity |

| Benchmark | FTSE All Share | FTSE All Share |

| Fund aim | The investment objective and policy of the fund is to achieve capital growth by exploiting a concentrated portfolio of UK company special situations with the potential for above average returns. | The fund is designed to outperform its benchmark. |

| Investment process | This concentrated, “best ideas” UK equity fund takes high conviction stock and sector positions based on the fund manager's top down market view, with a strong emphasis on earnings momentum. | The fund invests in shares of UK companies from all economic sectors. The main emphasis will be on shares in companies quoted on the London Stock Exchange. The core of this fund is invested in a FTSE 350 Tracker fund with the remainder being invested in other actively managed UK equity funds. |

| Management style | Active | Active |

An example of the letter issued to customers can be found here.

For further details of the RLP UK Equity fund please refer to the RLP UK Equity fund factsheet.

If you would like any further information on how this affects you, please contact us on 0345 605 0050.

RLP/JPMorgan Global Macro Sustainable fund name change – March 2025

Effective from 27 March 2025, the following fund has changed name:

| Existing | New | |

| Fund name | RLP/JPMorgan Global Macro Sustainable | RLP/JPMorgan Global Macro ESG |

Why is this change happening?

JP Morgan have made the change in order to comply with new regulatory rules known as UK Sustainability Disclosure Requirements.

The name of the fund has been changed to replace “Sustainable” with “ESG”, which stands for Environmental, Social and Governance.

RLP/Fidelity Sustainable Emerging Markets Equity & RLP/Fidelity MoneyBuilder Income - 20 March 2025

Effective from 20 March 2025, the following changes to the RLP Fidelity Sustainable Emerging Markets Equity & RLP Fidelity MoneyBuilder Income funds have taken place:

| Existing | New | |

| Fund name | RLP/Fidelity Sustainable Emerging Markets Equity | RLP/Fidelity Responsible Emerging Markets Equity |

| Fund aim | The fund aims is to achieve long term capital growth. | The Fund aims to increase the value of your investment over 5 years or more. |

| Investment process | It invests primarily in securities of companies having their head office or exercising a predominant part of their activity in the rapid growing and less developed countries of Central, Eastern and Southern Europe (including Russia), Middle East and Africa that are considered as emerging markets according to MSCI EM Europe, Middle East and Africa Index. It may also invest in other transferable securities, units in collective investment schemes, money market instruments, cash and deposits. The fund may use derivatives and forward transactions for investment purposes. | At least 70% of the Fund’s assets are invested in equities (and their related securities) of companies having their head office or exercising a predominant part of their activity in emerging markets globally including Asia, Latin America, Europe, Middle East and Africa according to the MSCI Emerging Markets (Net Total Return) Index. The Fund aims to achieve an ESG score for its portfolio greater than the benchmark index (MSCI Emerging Markets (Net Total Return) Index) after the exclusion of the 20% of securities in the benchmark with the lowest ESG ratings. The Fund may invest in securities of issuers with lower ESG ratings, including those with low but improving ESG characteristics. The Investment Manager aims to ensure companies held within the fund follow good governance practices. The Fund aims to hold a concentrated portfolio of 30-50 companies or other types of investment. The Fund may also hold other transferable securities, collective investment schemes, money market instruments, cash and deposits and derivatives for efficient portfolio management purposes. The Fund is actively managed. The Investment Manager will consider the MSCI Emerging Markets (Net Total Return) Index for the purposes of selecting investments and monitoring risk, however the Investment Manager has a wide degree of freedom to invest outside the index or take larger or smaller positions relative to it. The Investment Manager takes steps to prevent the Fund’s investments from conflicting with the sustainability characteristics by ensuring all assets comply with the Investment Manager’s exclusion framework. Exclusions include exposure to controversial weapons, conventional weapons, semi-automatic-weapons, tobacco, thermal coal, arctic oil and gas, oil sands, as well as those relating to international norms, such as human rights. Revenue thresholds and transition criteria apply. Fund specific exclusions may also be applied. |

| Fund name | RLP/Fidelity MoneyBuilder Income | RLP/Fidelity MoneyBuilder Corporate Bond |

| Fund aim | The fund aims to achieve an attractive level of income. | The Fund aims to deliver an income with the potential to increase the value of your investment. |

| Investment process | The fund aims to achieve an attractive level of return while keeping risk firmly under control from a richly diversified portfolio primarily invested in sterling-denominated (or hedged back to sterling) bonds issued by companies, all of which are regarded as ‘investment-grade’ by ratings agencies such as Moody’s and Standard & Poor’s. Emphasis is put on bottom up issuer selection and ensuring adequate diversity due to the asymmetric nature of corporate bond returns. | The Fund will be at least 70% exposed to sterling-denominated (or hedged back to sterling) investment grade debt instruments. The Fund is actively managed. The Investment Manager identifies suitable opportunities for the Fund utilising in-house research and investment capabilities. The Investment Manager will, when selecting investments for the Fund and for the purposes of monitoring risk, consider the ICE Bank of America Merrill Lynch Euro-Sterling Index. However, the Investment Manager has a wide degree of freedom relative to the index and may invest in issuers, sectors, countries and security types not included in the index in order to take advantage of investment opportunities. This means the Fund’s investments and therefore performance may vary significantly from the index. The Fund may also obtain exposure to transferable securities, money market instruments, collective investment schemes, cash and near cash and deposits. Derivatives may be used for efficient portfolio management and investment purposes and may include (but are not limited to) derivatives on exchange rates, interest rates, inflation and credit. The Fund may also take positions which enable it to benefit from falling asset prices. |

Why are we making these changes?

These rules are intended to enhance transparency and assist investors in identifying funds with sustainability credentials. Fund charges remain the same.

Changes to the RLP UK Small Cap Specialist (Ninety One UK Smaller Companies) fund – 7 March 2025

Effective from 7 March 2025, the following changes to the RLP UK Small Cap Specialist (Ninety One UK Smaller Companies) fund have taken place. This includes a name change to RLP UK Small Cap Specialist (Artemis UK Smaller Companies):

| Existing | New | |

| Fund name | RLP UK Small Cap Specialist (Ninety One UK Smaller Companies) | RLP UK Small Cap Specialist (Artemis UK Smaller Companies) |

| Benchmark | FTSE Small Cap (ex Investment Trust) Index | FTSE Small Cap (ex Investment Trust) Index |

| Fund aim | The fund aims to grow the value of your investment over the long term. | The fund aims to grow capital over a five year period. |

| Investment process | The fund invests primarily in the shares of UK smaller companies and in related derivatives (financial contracts whose value is linked to the price of an underlying asset). | The fund invests at least 80% in smaller companies. The manager adopts a long-term investment approach and seeks to mostly invest in companies with predictable and/or growing cashflow streams which require little additional capital to sustain. |

| Management style | Active | Active |

Please note that fund charges remain the same.

Why are we making these changes?

The RLP UK Small Cap Specialist (Ninety One UK Smaller Companies) Fund is one of our Matrix Funds – a group of equity funds categorised by sector and risk relative to a benchmark index. It currently invests in the Ninety One UK Smaller Companies Fund. However, Ninety One has advised us that it’s closing this fund.

After extensive analysis into alternative funds, our independently led Investment Advisory Committee, which oversees our investment range, has supported our proposal to replace it with the Artemis UK Smaller Companies Fund.

This change will take place on 7 March 2025.

Changes to our Target Lifestyle Strategies – February 2025

We’ve changed the structure of some of our Target Lifestyle Strategies to ensure we can operate more efficiently as the Governed Range grows.

One of the key benefits of our Governed Range is Royal London Asset Management’s ability to make tactical changes in response to market developments. But additional scale could restrict this, so the changes we’ve made support the efficient management of the Governed Range going forward.

What changed?

Since November 2020, it’s been possible to access fund versions of each of our Governed Portfolios that use the RLP Global Managed Fund as the equity component. Following the restructure our Target Lifestyle Strategies now use these funds in place of our previous portfolio structure. Tactical positions in these funds are taken in line with the portfolio versions – meaning there’s full alignment between the different versions of the Governed Portfolios and Governed Portfolio funds. And the changes won’t have any direct impact on you if you’re invested through a Target Lifestyle Strategy other than the way in which your investment option is presented.

What’s not changed?

There’s no impact to the overall objective or risk level for any of the impacted lifestyle strategies as a result of these changes. The way we manage the investments in the Governed Portfolio funds is in line with how we’ve managed the portfolios to date and we’ll continue to do this under the fund structure.

This change only impacts the Target Lifestyle Strategies that use the RLP Global Managed Fund for equity content. There’s no impact to Tracker or Active versions of lifestyle strategies or any Flexible Lifestyle Strategy arrangement that makes use of our overcode functionality.

Additionally, there’s no impact you directly invest in a Governed Portfolio or Governed Retirement Income Portfolio.

When did the changes take place?

Over the weekend of 7 February 2024, we completed the final phase of impacted strategies, which included moving the Royal London Workplace Default – the Balanced Lifestyle Strategy (Target Drawdown).

How we describe the investment options has not changed, but you may see a reduction in the number of funds shown in our communications, online services, and mobile app.

What lifestyle strategies were impacted?

Only the Target Lifestyle Strategies that use our RLP Global Managed Fund were impacted by these changes.

Target drawdown factsheets

- Adventurous Lifestyle Strategy (Drawdown)

- Moderately Adventurous Lifestyle Strategy (Drawdown)

- Balanced Lifestyle Strategy (Drawdown)

- Moderately Cautious Lifestyle Strategy (Drawdown)

- Cautious Lifestyle Strategy (Drawdown)

Target annuity factsheets

- Adventurous Lifestyle Strategy (Annuity)

- Moderately Adventurous Lifestyle Strategy (Annuity)

- Balanced Lifestyle Strategy (Annuity)

- Moderately Cautious Lifestyle Strategy (Annuity)

- Cautious Lifestyle Strategy (Annuity)

Target cash factsheets

Update to the RLP Global Equity Select fund – 20th December 2024

We issued communications in February and March 2024 relating to the soft closure of the RLP Global Equity Select fund and subsequent redirection to RLP Global Equity Blend for Governed Range customers and RLP Global Equity Diversified for direct customers

We can now confirm that the RLP Global Equity Select fund will be re-opened for all customers from 1 January 2025.

The fund will be available for selection for those investing directly and as an equity overcode in the Governed Range.

Customers who were switched into RLP Global Equity Blend or had regular premiums diverted to RLP Global Equity Diversified (Redirected) during the closure periods will NOT be automatically switched back into RLP Global Equity Select, however they can request this switch themselves.

RLP Global Equity Blend will remain open, and the fund is currently over 99% invested in the Global Equity Select strategy.

Update to Pension and Life Fund Illustration Growth Rates– 14th December 2024

The growth rates used on illustrations have now been updated. These are based on the latest asset class rates as decided by Royal London’s Long-Term Economic Assumptions Forum (LEAF).

Further details, and the growth rates for our pension and life funds can be found here.

Changes to the RLP Emerging Markets ESG Leaders Equity Tracker fund – 9 December 2024

Effective from 9 December 2024, the following changes to the RLP Emerging Markets ESG Leaders Equity Tracker fund have taken place:

| Existing | New | |

|---|---|---|

| Fund name | RLP Emerging Markets ESG Leaders Equity Tracker | RLP Emerging Markets Equity Tilt |

| Benchmark | MSCI Emerging Markets ESG Index | MSCI Emerging Markets ex China ‘A’ Index |

| Fund aim | The fund aims to track the capital performance of the MSCI Emerging Markets ESG Index. | The fund’s investment objective is to deliver capital growth and income over the medium term, which should be considered as a period of 3 to 5 years, by primarily investing in shares of emerging market companies by market capitalisation listed on major markets globally. The Fund will seek to achieve carbon intensity of at least 30% lower than that of the Index. |

| Investment process | The fund will invest primarily in the securities that make up the MSCI Emerging Markets ESG Index and instruments that provide exposure to these securities. The Index provides coverage of companies in emerging markets which have high environmental, social and governance (ESG) scores relative to their sector peers. | The fund is actively managed, meaning that the Investment Manager will use their expertise to select investments to meet the investment objective by primarily investing in shares of emerging market companies by market capitalisation listed on major markets globally. The fund will either exclude companies or take underweight or overweight stock-specific or sector-specific positions relative to the Index to achieve an improved Weighted Average Carbon Intensity (“WACI”). |

| Management style | Passive | Active |

Why are we making these changes?

The changes are designed to help the fund deliver reduced carbon emissions in line with its updated investment objective. This is part of our commitment to reduce emissions from our investment portfolio by 50% by 2030 and to achieve net zero by 2050.

An example letter issued to customers detailing these changes can be found here.

Does this impact Governed Range?

This change will also impact the benchmarks used in the Governed Range and the RLP Global Managed fund. Where we are currently using the MSCI Emerging Markets ESG Index to compare our Emerging Markets exposure, this will be change to the MSCI Emerging Markets ex China ‘A’ Index from 9 December.

This impacts the following funds/portfolios:

- All Governed Portfolios (GPs) and GPs as funds including the new Total Equity portfolio/fund

- All Governed Retirement Income Portfolios (GRIPs) and GRIP funds

- RLP Global Managed

- RLP/BlackRock ACS Global Blend

- RLP Global Blend Core Plus (RLP Global Growth)

Please note that charges across the various funds and portfolios affected remain the same as a result of these changes.

Changes to RLP / Ninety One Global Environment fund - 1 December 2024

Effective from 1 December 2024, the wording of the Investment Aim and Investment Process of the RLP / Ninety One Global Environment fund have been clarified as per the table below:

| Old aim | New aim |

| The Fund aims to grow the value of your investment and provide income over at least 5 year periods, after allowing for fees. | The Fund’s investment objective is to grow the value of your investment and provide income over the long term (at least 5 years), after allowing for fees. |

| Old investment process | New investment process |

| The Fund invests primarily (at least two-thirds and typically substantially more) in the shares of companies which the Investment Manager believes contribute to positive environmental change through sustainable decarbonisation (the process of reducing carbon dioxide emissions). The index used in the performance section is deemed to be a good representation of the Fund's investable universe and is widely used, independently calculated and readily available. | The Fund invests at least 70% (and typically substantially more) of its assets in the shares of companies around the world that meet its sustainability objective, specifically companies whose products and/or services avoid carbon, relative to their industry peers. The Fund has an impact sustainability objective to invest in and engage with companies whose products and/or services address the environmental challenge of climate change through decarbonisation (reducing greenhouse gas emissions to reduce global warming) to grow the provision of such products and/or services over at least 5 years. |

Please note that fund charges remain the same.

Changes to the RLP/Jupiter Ecology fund – 29 November 2024

Effective from 29 November 2024, the wording of the Investment Aim and Investment Process of the RLP/Jupiter Ecology fund have been clarified as per the table below:

| Old aim | New aim |

|---|---|

| To provide capital growth with the prospect of income, over the long term (at least five years) by investing in companies whose core products and services address global sustainability challenges. | To provide capital growth (with the prospect of income) over the long term (at least five years) by investing globally in companies that generate or enable positive solutions to climate change and/or environmental degradation through their products and services in clean energy, green mobility, green buildings and industry, sustainable agriculture and land, sustainable oceans and freshwater systems or the circular economy. |

| Old investment process | New investment process |

| At least 70% of the fund is invested in shares of companies based anywhere in the world whose core products and services address global sustainability challenges. Up to 30% of the fund may be invested in other assets, including shares of other companies, open-ended funds (including funds managed by Jupiter and its associates), cash and cash-type assets. Companies must meet both a comprehensive financial assessment and environmental and social criteria, including looking at a full range of ethical exclusions. | At least 70% of the Fund is invested directly in the shares of Environmental Solutions Companies based anywhere in the world. Up to 30% of the Fund may be invested in other assets such as closed-ended funds (including funds managed or operated by Jupiter or an associate of Jupiter), or shares of companies that have a 20-50% revenue alignment to the provision of solutions to climate change and/or environmental degradation and cash, near cash, money market instruments and deposits. |

Please note that fund charges remain the same.

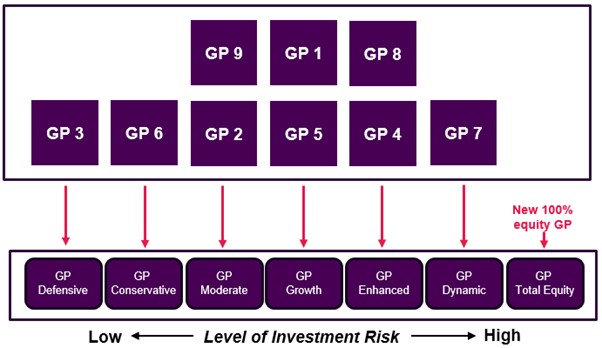

Changes to our Governed Portfolios and Governed Portfolio funds – 18th November 2024

As part of a regular review of the Governed Range, we’re making some changes to our Governed Portfolios and Governed Portfolio funds.

We’ve listened to feedback from our customers and used it to help us make our investment options easier to understand.

What’s changing?

We’ve changed the name of our Governed Portfolios and Governed Portfolio funds.

We’ve also changed our factsheets to make it easier for you to understand the risk level of your investments.

These changes will take effect from 18 November 2024.

What’s not changing?

These changes won't affect the current terms and conditions.

We haven’t changed any of the underlying investments or how they’re managed.

Our experts will continue to actively manage the Governed Portfolios and Governed Portfolio funds and ongoing oversight by our independently led Investment Advisory Committee will also remain in place.

Remember that investment returns may fluctuate and are not guaranteed.

You can find a copy of the letter issued to customers here (PDF).

Further details of the changes

Below is a summary of how the number of Governed Portfolios are reducing and being renamed to reflect their level of investment risk. You can also see which of the portfolios will map to the new names.

Please note that you won’t see any change to your investments when you log in online, apart from the change of name.

Strategic Asset Allocations

The latest Strategic Asset Allocations of the Governed Portfolios with the new names is shown below.

| Governed Portfolio Defensive | Governed Portfolio Conservative | Governed Portfolio Moderate | Governed Portfolio Growth | Governed Portfolio Enhanced | Governed Portfolio Dynamic | Governed Portfolio Total Equity | |

|---|---|---|---|---|---|---|---|

| Equities | 12.50% | 32.50% | 43.75% | 57.50% | 71.25% | 80.00% | 100.00% |

| Property | 5.00% | 7.50% | 8.75% | 10.00% | 11.25% | 12.50% | - |

| Commodities | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | - |

| Global high yield bonds | 7.50% | 5.00% | 5.00% | 5.00% | 2.50% | 2.50% | - |

| UK corporate bonds | 9.00% | 6.25% | 5.00% | 3.25% | 1.50% | - | - |

| Global corporate bonds | 3.50% | 2.50% | 2.50% | 1.75% | 0.50% | - | - |

| Short duration UK corporate bonds | 12.50% | 10.00% | 7.50% | 2.50% | - | - | - |

| UK index linked bonds | 2.50% | 2.50% | 2.50% | 2.50% | 1.00% | - | - |

| Short duration global index linked bonds | 7.50% | 5.00% | 2.50% | - | - | - | - |

| UK government bonds | 9.50% | 6.75% | 5.75% | 5.75% | 1.50% | - | - |

| Global government bonds | 3.00% | 2.00% | 1.75% | 1.75% | 0.50% | - | - |

| Short duration UK government bonds | 10.00% | 5.00% | 2.50% | - | - | - | - |

| Absolute return strategies (incl. cash) | 12.50% | 10.00% | 7.50% | 5.00% | 5.00% | - | - |

Lifestyle strategies

If you are invested in a lifestyle strategy, there will be no changes made other than the renaming of the component parts of the strategy as show below.

| Risk category | Your Lifestyle journey | |||

|---|---|---|---|---|

| 15 years+ | 10 years | 5 years | Retirement | |

| Cautious | GP Growth (GP1) | GP Moderate (GP2) | GP Defensive (GP3) |

Target Cash (RLP Deposit) |

| Moderately Cautious | GP Enhanced (GP4) | GP Growth (GP5) | GP Defensive (GP3) | Target Cash (RLP Deposit) Target Annuity (RLP Annuity) Target Drawdown (GRIP 2) |

| Balanced | GP Enhanced (GP4) | GP Growth (GP5) | GP Conservative (GP6) | Target Cash (RLP Deposit) Target Annuity (RLP Annuity) Target Drawdown (GRIP 3) |

| Moderately Adventurous | GP Dynamic (GP7) | GP Growth (GP5) | GP Conservative (GP6) | Target Cash (RLP Deposit) Target Annuity (RLP Annuity) Target Drawdown (GRIP 4) |

| Adventurous | GP Dynamic (GP7) | GP Enhanced (GP8) | GP Moderate (GP9) | Target Cash (RLP Deposit) Target Annuity (RLP Annuity) Target Drawdown (GRIP 5) |

Changes to the RLP Annuity fund

We are changing the investment objective and benchmark of the RLP Annuity fund. To help explain some of the terminology used here, we have prepared a short glossary of investment terms.

Why are we changing the investment objective and how does this impact me?

We believe the investment objective of RLP Annuity fund can be changed to better line up with the primary aim for customers who are approaching retirement and look to take tax-free cash and purchase an annuity.

This change doesn’t affect the way the fund is managed or its purpose. The benefit of this change is to provide more clarity on what the fund aims to do and how it does this.

Why are we changing the benchmark and how does this affect me?

The GMAP Diversified Bond fund, which RLP Annuity invests in, has changed its asset allocation and benchmark. We are changing the fund’s benchmark to better reflect the new investments it holds.

This new benchmark becomes a better comparator to measure fund performance against. We believe the new asset allocation is still suitable for customers, which now includes a small amount of investments in bonds outside of the UK to strengthen the diversification of the fund.

If you would like to know more about the new investments held in GMAP Diversified Bond, please click here.

What’s changing?

The current RLP Annuity fund investment objective and benchmark are:

“To deliver above inflation growth for customers approaching retirement who intend to take up to 25% tax-free cash and buy an annuity in the short term.”

| Benchmarks | Asset Allocation | Region | ||

| 25% | SONIA | 25% | Cash | UK |

| 25% | Markit iBoxx Sterling Non-Gilts over 5 years | 25% | Corporate Bonds | UK |

| 25% | various FTSE A UK Gilt indices | 25% | Government Bonds | UK |

| 25% | various FTSE A Index Linked Gilt indices | 25% | Index-Linked Government Bonds | UK |

The revised RLP Annuity fund investment objective and benchmark are:

“This fund is designed for customers approaching retirement who intend to take tax-free cash and purchase an annuity. The fund invests in a mixture of bonds which aim to achieve a reasonably stable level of annuity income when purchasing an annuity. The fund also invests in cash like assets to support a tax-free cash withdrawal.”

| Benchmarks | Asset Allocation | Region | ||

| 25.0% | SONIA | 25% | Cash | UK |

| 17.5% | Markit iBoxx Sterling Non-Gilts Index | 25% | Corporate Bonds | UK |

| 7.5% | Bloomberg Global Aggregate Corporate index (GBP hedged) | Overseas | ||

| 20.0% | FTSE A UK Gilts All Stocks index | 25% | Government Bonds | UK |

| 5.0% | JPM Global ex-UK Traded index (GBP hedged) | Overseas | ||

| 20.0% | FTSE A UK Index-Linked Gilts All Stocks index | 25% | Index-Linked Government Bonds | UK |

| 1.5% | Bloomberg UK Government Inflation Linked Bond 1-10 Year index | |||

| 3.5% | Bloomberg World Government Inflation Linked Bond (ex UK) 1-10 Year (GBP hedged) | Overseas | ||

The Annual Management Charge (AMC) and Total Expense Ratio (TER) will remain unchanged.

What happens next?

You don’t need to do anything as the change will happen automatically from week commencing 18th November 2024. However, should you wish to review your current fund choices you can find more information about our fund range by clicking here.

If you are unsure about the best course of action, you should speak to a financial adviser. If you don’t have a financial adviser, you can find a professional in your area. Find out more here.

If you’re unsure about anything else and would like to chat, you can contact us at 0345 605 0050.

Royal London external fund and lifestyle strategy closures – September 2024

We regularly review the Royal London pension fund range to ensure the available funds remain appropriate to our customers. A recent review has identified some externally managed funds that aren’t providing value for money for our customers. We have taken the decision to close these funds and redirect investments into alternative replacement funds.

These fund closures also impact some lifestyle strategies that we offer. We have taken the decision to close these lifestyle strategies and redirect investments into a replacement lifestyle strategy that closely matches the existing lifestyle strategy.

If you are impacted by any of the fund or lifestyle strategy closures, you will have received a letter from Royal London providing details of the changes and when these will take place.

What’s changing?

Your investments will move from the closing funds or lifestyle strategy into replacement funds or lifestyle strategy week commencing 16th September 2024.

We’ll redirect any future contributions to the replacement funds or lifestyle strategy following the change.

Any additional fund management charges you are currently paying for externally managed funds will be removed.

What options do I have?

Should you wish to review your current investment choice and request a change you can do this at any time using your online login.

If you don’t choose a new option, we’ll move the value of your investment in the closing funds or lifestyle strategy into the replacement funds or lifestyle strategy on your behalf. We’ll also redirect any future contributions being paid to the closing funds or lifestyle strategy into the replacement funds or lifestyle strategy.

This change will take effect week commencing 16 September 2024.

What happens next?

Unless you specify an alternative investment instruction the change will take effect week commencing 16 September 2024 and we’ll move the value of your investments in the closing funds or lifestyle strategy into the replacement funds or lifestyle strategy on your behalf. We’ll also redirect any future contributions being paid to the closing funds or lifestyle strategy into the replacement funds or lifestyle strategy.

About the closing funds and replacements

We have produced a brochure to provide more details around the replacement funds and lifestyle strategies and why these are a good match to your existing investments. The letter you will have received will confirm the change reference so you can easily find the investment changes you are impacted by.

We have issued a letter (see example) to customers. For further details about our fund range please visit www.royallondon.com/pensions/investment-options/fund-range/.

If you would like any further information on how this affects you, please contact us on 0345 605 0050 or email us at CustomerQueries@royallondon.com.

Changes to Investment Pathway 2

Changes to Investment Pathway 2

Effective from 12 July 2024, the underlying investment strategy of Investment Pathway 2 is changing from RLP Annuity to RLP GRIP 1.

What is RLP GRIP 1?

RLP GRIP 1 is a multi-asset portfolio that aims to deliver growth above inflation, whilst taking a level of risk consistent with a risk rating 1 risk attitude.

Why is this changing?

On the back of our annual review of the Investment Pathways and future economic outlook we believe that RLP GRIP 1 better meets customer needs; to maintain annuity purchasing power whilst in drawdown for a short period of time.

How does this impact me?

Overall, there should be no impact to you. The Investment Pathway 2 objective remains the same. RLP GRIP 1 delivers well against key needs; to maintain annuity purchasing power whilst providing potential for growth with a small allocation to growth seeking assets.

Product charges are not changing as a result of this investment strategy change.

What if I no longer want to be invested in Pathway 2?

If you no longer want to be invested in Investment Pathway 2 then either contact your financial adviser, contact customer services on 0345 60 50 050 or log onto our online service to make an investment change.

Matrix Fund changes

We regularly review the funds held in the Royal London Matrix Range to ensure they remain appropriate for our customers. A review carried out has identified several funds that are either underperforming or require changes based on the performance benchmark they are measured against or the risk category they sit in.

The impacted funds and the type of change taking place are shown below:

Fund Replacements

| Change | Fund Name |

|---|---|

| Existing Fund Replacement Fund |

RLP UK Equity Core Plus (Close TEAMS UK Equities (1%)) RLP UK Equity Core Plus (JPM UK Dynamic) |

| Existing Fund Replacement Fund |

RLP UK Equity Core Plus (Close TEAMS UK Equities (2%)) RLP UK Equity Core Plus (JPM UK Dynamic) |

| Existing Fund Replacement Fund |

RLP UK Equity Core Plus (JPM UK Equity Growth) RLP UK Equity Core Plus (Artemis Income) |

| Existing Fund Replacement Fund |

RLP Emerging Markets Specialist (Fidelity Emerging Markets) RLP Emerging Markets Specialist (First Sentier FSSA Global Emerging Markets Focus) |

Fund Name and Risk Category Changes

The following funds are moving risk category within the Royal London Matrix Range. For further information on how these risk categories work, please click here.

| Current Fund Name | New Fund Name |

|---|---|

| RLP UK Income Specialist (Fidelity MoneyBuilder Dividend) | RLP UK Income Core Plus (Fidelity MoneyBuilder Dividend) |

| RLP Asia Pacific Core Plus (Stewart Investors Asia Pacific Leaders Sustainability) | RLP Asia Pacific Specialist (Stewart Investors Asia Pacific Leaders Sustainability) |

Fund Benchmark Changes

| Fund Name | Current Benchmark | New Benchmark |

|---|---|---|

| RLP Global Managed Equity Specialist (Invesco Global Equity) | 55% FTSE All Share, 45% FTSE AW ex UK | MSCI ACWI |

| RLP Global Managed Equity Specialist (Ninety One Global Strategic Equity) | 55% FTSE All Share, 45% FTSE AW ex UK | MSCI ACWI |

| RLP UK Income Core Plus (Artemis Income) | FTSE 350 Higher Yield Index | FTSE All Share |

| RLP UK Income Specialist (Fidelity MoneyBuilder Dividend) | FTSE 350 Higher Yield Index | FTSE All Share |

These changes will take place week commencing 14 October 2024.

For more detail on all of these changes, please follow the link here.

Closure of Tilney funds and lifestyle strategies – August 2024

We regularly review the Royal London pension fund range to ensure the available funds remain appropriate to our customers. A recent review has identified some externally managed funds that aren’t providing value for money for our customers. We have taken the decision to close these funds and redirect investments into alternative replacement funds.

These fund closures also impact some lifestyle strategies that we offer. We have taken the decision to close these lifestyle strategies and redirect investments into a replacement lifestyle strategy that closely matches the existing lifestyle strategy.

If you are impacted by any of the fund or lifestyle strategy closures, you will have received a letter from Royal London providing details of the changes and when these will take place.

How have we decided on the replacement fund?

We looked at all available alternative funds in the Royal London range against a set of criteria to make sure we identified the closest possible match to existing investments. Our Investment Advisory Committee (IAC) also reviewed each mapping to make sure we’d chosen the most appropriate investment option.

What’s changing?

Your investments will move from the closing fund/lifestyle strategy into a replacement fund/lifestyle strategy week commencing 5th August 2024.

We’ll redirect any future contributions to the replacement fund/lifestyle strategy following the change.

Any additional fund management charges you are currently paying for externally managed funds will be removed.

What options do I have?

Should you wish to review your current investment choice and request a change you can do this at any time using your online login.

If you don’t choose a new option, we’ll move the value of your investment in the closing fund/lifestyle strategy into the replacement fund/lifestyle strategy on your behalf. We’ll also redirect any future contributions being paid to the closing lifestyle strategy into the replacement fund/lifestyle strategy.

This change will take effect week commencing 5th August 2024 and you’ll receive an automatically generated letter confirming that your investments have been switched.

What happens next?

Unless you specify an alternative investment instruction the change will take effect week commencing 5th August 2024 and we’ll move the value of your investments in the closing fund/lifestyle strategy into the replacement fund/lifestyle strategy on your behalf. We’ll also redirect any future contributions being paid to the fund/lifestyle strategy into the replacement fund/lifestyle strategy.

About the closing funds and replacements

|

Closing Fund |

Replacement Fund |

|

| Fund Name | RLP/Tilney Defensive Portfolio | RLP Governed Portfolio 3 |

| Aim / Investment Process |

The aim of the fund is to achieve, over the long term, an investment return of income and capital growth. The fund will primarily invest in Collective Investment Schemes which have an investment focus in defensive asset classes. Your Defensive portfolio is a well diversified portfolio, designed to achieve stable, risk adverse long term investment returns but will seek to maximise return for every unit of risk taken. The majority of your portfolio will typically be invested in Fixed Interest investments. |

This fund aims to deliver above inflation growth, whilst taking a low level of investment risk relative to the other funds in the Governed Portfolio range. Investment risk is a measure of the expected volatility. On a scale rating the investment risk of Governed Portfolios from 1 to 7, with 1 being the lowest, this fund is a 1. The fund invests in a range of asset classes, that can include, but is not limited to equities, fixed interest, cash, property, and commodities. |

| Benchmark | The fund does not operate to a strict benchmark. | Composite benchmark aligned to strategic asset allocation |

| ABI Sector | Mixed Investment 0-35% Shares | Mixed Investment 0-35% Shares |

| Annual Management Charge | 2.19% | 1.00% |

| Fund Manager | Tilney | Royal London Asset Management |

|

Closing Fund |

Replacement Fund | |

| Fund Name | RLP/Tilney Growth Portfolio | RLP Governed Portfolio 8 |

| Aim / Investment Process |

The aim of the fund is to achieve, over the long term, an investment return of capital growth. The fund will primarily invest in Collective Investment Schemes which have an investment focus in growth asset classes. Your Growth portfolio is a well diversified portfolio, designed to capture most of the benefits of rising investment markets and to reduce the effects of market downturns. The portfolio will seek to maximise return for every unit of risk taken. The portfolio will typically have significant exposure to equities. |

This fund aims to deliver above inflation growth, whilst taking a medium to high level of investment risk relative to the other funds in the Governed Portfolio range. Investment risk is a measure of the expected volatility. On a scale rating the investment risk of Governed Portfolios from 1 to 7, with 1 being the lowest, this fund is a 5. The fund invests in a range of asset classes, that can include, but is not limited to equities, fixed interest, cash, property, and commodities. |

| Benchmark | The fund does not operate to a strict benchmark. | Composite benchmark aligned to strategic asset allocation |

| ABI Sector | Mixed Investment 40-85% Shares | Mixed Investment 40-85% Shares |

| Annual Management Charge | 2.14% | 1.00% |

| Fund Manager | Tilney | Royal London Asset Management |

|

Closing Fund |

Replacement Fund | |

| Fund Name |

RLP/Tilney Mixed Portfolio |

RLP Governed Portfolio 9 |

| Aim / Investment Process |

The aim of the fund is to achieve, over the long term, an investment return of income and capital growth. The fund will primarily invest in Collective Investment Schemes which primarily invest in debt and equity securities. Your Mixed portfolio is a well diversified and balanced portfolio, designed to capture most of the benefits of rising investment markets and to reduce the effects of market downturns. The portfolio will seek to maximise return for every unit of risk taken. The portfolio will typically have significant exposure to Equities, Bonds and Commercial Property. |

This fund aims to deliver above inflation growth, whilst taking a medium level of investment risk relative to the other funds in the Governed Portfolio range. Investment risk is a measure of the expected volatility. On a scale rating the investment risk of Governed Portfolios from 1 to 7, with 1 being the lowest, this fund is a 3. The fund invests in a range of asset classes, that can include, but is not limited to equities, fixed interest, cash, property, and commodities. |

| Benchmark | The fund does not operate to a strict benchmark. | Composite benchmark aligned to strategic asset allocation |

| ABI Sector | Mixed Investment 40-85% Shares | Mixed Investment 20-60% Shares |

| Annual Management Charge | 2.20% | 1.00% |

| Fund Manager | Tilney | Royal London Asset Management |

About the closing lifestyle strategies and replacements

| Closing Lifestyle | Replacement Lifestyle | |

| Fund Name | Tilney Defensive Lifestyle Strategy | Cautious Lifestyle Strategy (Target Annuity) |

| Target Retirement Outcome | Lifestyle targets an Annuity end point | Lifestyle targets an Annuity end point |

| Risk Level | Whilst not stated the underlying fund mappings and replacement solution indicate a Cautious risk level is appropriate. | Cautious |

| Fund Manager | Tilney (majority manager) | Royal London Asset Management |

|

Closing Lifestyle |

Replacement Lifestyle | |

| Fund Name | Tilney Growth Lifestyle Strategy | Adventurous Lifestyle Strategy (Target Annuity) |

| Target Retirement Outcome | Lifestyle targets an Annuity end point | Lifestyle targets an Annuity end point |

| Risk Level | Whilst not stated the underlying fund mappings and replacement solution indicate an Adventurous risk level is appropriate. | Adventurous |

| Fund Manager | Tilney (majority manager) | Royal London Asset Management |

|

Closing Lifestyle |

Replacement Lifestyle | |

| Fund Name | Tilney Total Lifestyle Strategy | Adventurous Lifestyle Strategy (Target Annuity) |

| Target Retirement Outcome | Lifestyle targets an Annuity end point | Lifestyle targets an Annuity end point |

| Risk Level | Whilst not stated the underlying fund mappings and replacement solution indicate an Adventurous risk level is appropriate. | Adventurous |

| Fund Manager | Tilney (majority manager) | Royal London Asset Management |

Strategic Asset Allocation (SAA) changes to our Governed Range – 30 June 2024

We're making changes to the strategic asset allocation (SAA) of our Governed Portfolios (GPs) and Governed Retirement Income Portfolios (GRIPs) to help improve risk-adjusted returns and income sustainability.

Our analysis has shown that the current SAAs for the GPs and GRIPs remain efficient and are positioned well to deal with a wide range of economic scenarios, however we are proposing some small changes as outlined below:

- A change in the regional equity mix underlying the Governed Range to reflect a reduction in UK exposure by 5%. This is to enable portfolios to benefit from greater exposure to quality growth-oriented sectors;

- A reduction in property allocations by 1.25% for GPs 2,4,8 and 9, into equities to smooth allocations across the risk spectrum; and

- A reduction in property allocations by 1.25% for GRIPs 2 and 4 into equities to smooth allocations across the GRIPs risk spectrum to ensure consistency with the GPs and coherence across our investment proposition.

Further Details:

Regional equity mix

The increase in exposure to Developed Markets continues our move to a broader global approach to equities and aims to provide customers with greater exposure to faster growing sectors not well represented in the UK market.

What’s changing?

We are changing the global equity allocation benchmark from 25% FTSE All Share: 65% FTSE World: 10% Emerging Markets ESG Leaders to 20% FTSE All Share: 70% FTSE World: 10% Emerging Markets ESG Leaders.

Property

Direct property is a valuable component across the Governed Range because we believe that it improves portfolio diversification and provides exposure to strong inflation-linked returns over the long term.

We believe the current strategic weightings are well positioned and correctly balance against long term customer outcomes. We are therefore proposing no material changes to the property allocations.

What’s changing?

We are reducing the property allocations in GPs 2,4,8 and 9 by 1.25% into equities to enable a smooth stepping of property allocations across the risk spectrum.

In order to ensure consistency between the GPs and the GRIPs, we are also smoothing the property allocations across the GRIPs risk spectrum by reducing the property weighting in GRIPs 2 and 4 by 1.25% into equities.

The proposed changes do not materially impact the risk and return profile of the concerned GPs and GRIPs.

New SAAs for GPs and GRIPs are in the tables below:

GPs – new SAA

| Cautious | Balanced | Adventurous | |||||||

|---|---|---|---|---|---|---|---|---|---|

| GP1 | GP2 | GP3 | GP4 | GP5 | GP6 | GP7 | GP8 | GP9 | |

| Equity | 57.50% | 43.75% | 12.50% | 71.25% | 57.50% | 32.50% | 80.00% | 71.25% | 43.75% |

| Property | 10.00% | 8.75% | 5.00% | 11.25% | 10.00% | 7.50% | 12.50% | 11.25% | 8.75% |

| Commodities | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% |

| Global High Yield Bonds | 5.00% | 5.00% | 7.50% | 2.50% | 5.00% | 5.00% | 2.50% | 2.50% | 5.00% |

| UK Corporate Bonds | 3.25% | 5.00% | 9.00% | 1.50% | 3.25% | 6.25% | 0.00% | 1.50% | 5.00% |

| Global Corporate Bonds | 1.75% | 2.50% | 3.50% | 0.50% | 1.75% | 2.50% | 0.00% | 0.50% | 2.50% |

| Short Duration UK Corporate Bonds | 2.50% | 7.50% | 12.50% | 0.00% | 2.50% | 10.00% | 0.00% | 0.00% | 7.50% |

| UK Index Linked | 2.50% | 2.50% | 2.50% | 1.00% | 2.50% | 2.50% | 0.00% | 1.00% | 2.50% |

| Short Duration UK Index Linked | 0.00% | 0.75% | 2.25% | 0.00% | 0.00% | 1.50% | 0.00% | 0.00% | 0.75% |

| Short Duration Global Index Linked | 0.00% | 1.75% | 5.25% | 0.00% | 0.00% | 3.50% | 0.00% | 0.00% | 1.75% |

| UK Government Bonds | 5.75% | 5.75% | 9.50% | 1.50% | 5.75% | 6.75% | 0.00% | 1.50% | 5.75% |

| Global Government Bonds | 1.75% | 1.75% | 3.00% | 0.50% | 1.75% | 2.00% | 0.00% | 0.50% | 1.75% |

| Short Duration UK Government Bonds | 0.00% | 2.50% | 10.00% | 0.00% | 0.00% | 5.00% | 0.00% | 0.00% | 2.50% |

| Absolute Return Strategies (including Cash) | 5.00% | 7.50% | 12.50% | 5.00% | 5.00% | 10.00% | 0.00% | 5.00% | 7.50% |

GRIPs – new SAA

| GRIP 1 | GRIP 2 | GRIP 3 | GRIP 4 | GRIP 5 | |

|---|---|---|---|---|---|

| Equity | 12.50% | 23.75% | 30.00% | 41.25% | 50.00% |

| Property | 5.00% | 6.25% | 7.50% | 8.75% | 10.00% |

| Commodities | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% |

| Global High Yield Bonds | 5.00% | 5.00% | 5.00% | 6.25% | 6.25% |

| UK High Yield Bonds | 5.00% | 5.00% | 5.00% | 6.25% | 6.25% |

| UK Corporate Bonds | 14.00% | 13.00% | 10.00% | 7.25% | 4.00% |

| Global Corporate Bonds | 4.00% | 3.50% | 3.25% | .00% | .00% |

| Short Duration UK Corporate Bonds | 4.50% | 4.50% | 3.00% | 2.00% | 1.50% |

| UK Index Linked | 5.00% | 5.00% | 5.00% | 3.75% | 2.50% |

| Short Duration UK Index Linked | 1.50% | 0.75% | 0.75% | 0.00% | 0.00% |

| Short Duration Global Index Linked | 3.50% | 1.75% | 1.75% | 0.00% | 0.00% |

| UK Government Bonds | 10.00% | 10.00% | 9.75% | 5.00% | 4.00% |

| Global Government Bonds | 4.00% | .75% | 2.50% | 2.50% | 1.00% |

| Short Duration UK Government Bonds | 11.00% | 2.75% | 1.50% | 0.00% | 0.00% |

| Absolute Return Strategies (including Cash) | 10.00% | 10.00% | 10.00% | 10.00% | 7.50% |

Changes to the RLP/M&G Recovery fund – May 2024

Following a full review of the M&G Recovery Fund (the “Fund”), M&G have confirmed some changes, which they believe will increase the Fund’s ability to achieve its Investment Objective and reduce the risk of “underperforming” its target benchmark, the FTSE All-Share Index (the “Index”). Underperformance occurs when the Fund’s returns are lower than those of the Index.

What’s changing?

Effective from Tuesday 28 May 2024 (the “Effective Date”), the Fund will be able to invest up to 20% of its Net Asset Value (“NAV”) in companies which are not considered to be “recovery companies” as defined in the Fund’s current Investment Approach. These companies will be components of the Index.

There will be no change to the Fund’s Investment Objective or to its overall risk profile. The change will not result in any immediate portfolio changes and charges remain the same.

Why is the change happening?

The Fund aims to deliver a higher total return (the combination of capital growth and income), net of the fund charge, than that of the Index over any five-year period. However, the nature of recovery investing means that the Fund’s composition may differ considerably from that of the Index. For example, the Fund may be less, or not at all, invested in a specific sector or company which is heavily represented in the Index. When these sectors or companies are performing strongly, it increases the risk of the Fund underperforming the Index.

The ability to invest in non-recovery companies will provide the fund manager with added flexibility to take tactical positions in companies or sectors within the Index that have the potential to perform strongly to reduce the risk of the Fund underperforming the Index. It should be noted that M&G only expect the Fund to invest in these companies to a limited extent and they will not exceed 20% of the Fund’s NAV at any given time. The fund manager remains committed to achieving the Fund’s objective by identifying recovery companies that can deliver long-term returns to investors.

Changes to the RLP Sustainable World Trust – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Sustainable World Trust have been clarified as per the table below:

| Old aim | New aim |

|

The fund aims to achieve first quartile performance over a rolling three-year period measured against its sector. |

The fund aims to achieve first quartile performance over a rolling three-year period measured against its sector. Investments in the fund will adhere to the manager's ethical and sustainable investment policy. |

| Old investment process | New investment process |

|

The investment objective is to provide medium to long-term capital growth via worldwide investments in multiple asset classes that adhere to the manager's sustainable investment policy. |

At least 50%, up to a maximum of 85%, of the fund’s assets will be invested in the shares of companies globally. These will be businesses that are listed on stock exchanges in their respective countries. Of the remaining assets not invested in shares, at least 80% will be invested in sterling-denominated (or hedged back to sterling) investment grade corporate bonds, up to a maximum of 40% of the fund’s assets. Sub-investment grade bonds are limited to a maximum of 2% of the fund’s assets. The fund may invest up to 10% in other investment funds, known as collective investment schemes. Typically, only a small portion of assets will be invested in cash. The fund may also invest a small amount of its portfolio in derivatives (investments that derive their value from another closely related underlying investment) for investment purposes and efficient portfolio management (EPM). The fund focuses on the sustainability of the products and services of the companies it invests in, as well as their standards of environmental, social and governance (ESG) management, alongside financial analysis. |

Please note that fund charges remain the same.

Changes to the RLP Sustainable Managed Growth Trust – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Sustainable Managed Growth Trust have been clarified as per the table below:

| Old aim | New aim |

|

The investment objective is to provide a total return by way of accumulated income, with some capital growth. |

The fund aims to provide a total return by way of accumulated income, with some capital growth. Investments in the fund will adhere to the manager's ethical and sustainable investment policy. |

| Old investment process | New investment process |

|

The fund invests mainly in fixed income securities with some equities, mainly in the United Kingdom. Investments in the fund will adhere to the manager's sustainable investment policy. The fund aims to achieve first quartile performance over a rolling three-year period measured against its sector. |

At least 65% of the fund will be invested in bonds (typically sterling-denominated), both government and corporate. Between 30% and 70% of the fund's investment will be in investment grade corporate bonds. A maximum of 35% of the fund will be invested in the shares of companies globally. These will be businesses that are listed on stock exchanges in their respective countries. The remainder of the fund’s assets may be invested in a range of securities, including UK government bonds, index-linked bonds, securitisations, supranational bonds, preference shares, floating-rate notes, asset-backed securities, and bonds denominated in currencies other than sterling. The fund may invest up to 10% in other investment funds, known as collective investment schemes. Typically, only a small portion of assets will be invested in cash. The fund may also invest a small amount of its portfolio in derivatives (investments that derive their value from another closely related underlying investment) for investment purposes and efficient portfolio management (EPM). The fund focuses on the sustainability of the products and services of the companies it invests in, as well as their standards of environmental, social and governance (ESG) management, alongside financial analysis. |

Please note that fund charges remain the same.

Changes to the RLP Sustainable Leaders Trust – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Sustainable Leaders Trust have been clarified as per the table below:

| Old aim | New aim |

|

The fund aims to provide growth in the value of your investment over time, by investing predominantly in the shares of UK companies. |

The fund aims to provide growth in the value of your investment over time, by investing predominantly in the shares of UK companies. Investments in the fund will adhere to the manager's ethical and sustainable investment policy. |

| Old investment process | New investment process |

|

The investments picked for this fund are chosen because they have a net positive benefit on society either through their products and services they offer or in the way they conduct their business. This means the fund will not invest in all areas of the market. At least 80% of the fund's investments are in the shares of UK companies. Up to 20% of the fund can be invested in shares in overseas companies. Simple avoidance means that the fund does not invest in companies whose core activities include the production of nuclear power, manufacture of armaments or animal testing for non-medical purposes. The system of scoring assesses companies according to specific criteria. This is intended to provide a balance between positive and negative factors, and allow the fund to identify the best companies in their sector |

At least 80% of the fund's assets will be invested in Policy shares of UK companies which are listed on the London Stock Exchange. Where the manager believes it is in the best interests of the fund, they may invest up to 20% of the fund's assets in shares of overseas companies. The fund may invest up to 10% in other investment funds, known as collective investment schemes. Typically, only a small portion of assets will be invested in cash. The fund may also invest a small amount of its portfolio in derivatives (investments that derive their value from another closely related underlying investment) for efficient portfolio management (EPM). The fund focuses on the sustainability of the products and services of the companies it invests in, as well as their standards of environmental, social and governance (ESG) management, alongside financial analysis. |

Please note that fund charges remain the same.

Changes to the RLP Sustainable Diversified Trust – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Sustainable Diversified Trust have been clarified as per the table below:

| Old aim | New aim |

|

The fund aims to provide first-quartile performance over a rolling three-year period measured against the IA Mixed Investment 20-60% Shares Sector. |

The fund aims to provide first-quartile performance over a rolling three-year period measured against the IA Mixed Investment 20-60% Shares Sector. Investments in the fund will adhere to the manager's ethical and sustainable investment policy. |

| Old investment process | New investment process |

|

The fund invests in companies with products or services that benefit the core themes of environment, human welfare, and sustainability. Companies leading their industries in ESG performance, as assessed by our analysts, are also included in the investable universe, thereby creating a portfolio of investments that make a positive contribution to society. |

A maximum of 60% of the fund's assets will be invested in the shares of companies globally. These will be businesses that are listed on stock exchanges in their respective countries. Of the remaining assets not invested in shares, at least 80% will be invested in sterling-denominated (or hedged back to sterling) investment grade corporate bonds. Sub-investment grade bonds are limited to a maximum of 5% of the fund’s assets. The fund is required to keep at least 30% of its assets in bonds and cash. The fund may invest up to 10% in other investment funds, known as collective investment schemes. Typically, only a small portion of assets will be invested in cash. The fund may also invest a small amount of its portfolio in derivatives (investments that derive their value from another closely related underlying investment) for investment purposes and efficient portfolio management (EPM). The fund focuses on the sustainability of the products and services of the companies it invests in, as well as their standards of environmental, social and governance (ESG) management, alongside financial analysis. |

Please note that fund charges remain the same.

Changes to the RLP Sustainable Corporate Bond Trust – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Sustainable Corporate Bond Trust have been clarified as per the table below:

| Old aim | New aim |

|

The fund’s investment objective is to achieve a total return (a combination of capital growth and income) over the medium term, which should be considered as a period of 3-5 years. |

The fund aims to achieve a total return (a combination of capital growth and income) over the medium term, which should be considered as a period of 3-5 years. Investments in the fund will adhere to the manager's ethical and sustainable investment policy. |

| Old investment process | New investment process |

|

Typically, the fund’s assets will be invested 80% in a diversified portfolio of sterling-denominated bonds issued by corporates and supranational institutions. The fund may also invest in global bonds, government bonds and cash. Investments in the fund will adhere to the manager's sustainable investment policy |

Typically, a minimum of 80% of the fund’s assets will be invested in a diversified portfolio of sterling-denominated (or hedged back to sterling) investment grade corporate and supranational bonds. The remainder of the fund’s assets may be invested in a range of securities, including government bonds, index-linked bonds, securitisations, convertible debt, investment without an investment grade credit rating, preference shares, floating-rate notes, asset-backed securities and bonds denominated in currencies other than sterling. The Fund may invest up to 10% in other investment funds, known as collective investment schemes. Typically, only a small portion of assets will be invested in cash. The fund may also invest a small amount of its portfolio in derivatives (investments that derive their value from another closely related underlying investment) for investment purposes and efficient portfolio management (EPM). The fund focuses on the sustainability of the products and services of the companies it invests in, as well as their standards of environmental, social and governance (ESG) management, alongside financial analysis. |

Please note that fund charges remain the same.

Changes to the RLP / Jupiter Ecology fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP / Jupiter Ecology fund have been clarified as per the table below:

| Old aim | New aim |

|

The objective of the fund is to achieve long-term capital appreciation together with a growing income consistent with a policy of protecting the environment. |

The fund's objective is to provide long-term capital growth (at least five years) with the prospect of income by investing in companies whose core products and services address global sustainability challenges. |

| Old investment process | New investment process |

|

The fund's investment policy is to invest in equities worldwide in companies which demonstrate a positive commitment to the long-term protection of the environment. |

At least 70% of the fund is invested in shares of companies based anywhere in the world whose core products and services address global sustainability challenges. Up to 30% of the fund may be invested in other assets, including shares of other companies, open-ended funds (including funds managed by Jupiter and its associates), cash and cash-type assets. Companies must meet both a comprehensive financial assessment and environmental and social criteria, including looking at a full range of ethical exclusions. |

Please note that fund charges remain the same.

Changes to the RLP / JPMorgan Global Macro Sustainable fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP / JPMorgan Global Macro Sustainable fund have been clarified as per the table below:

| Old aim | New aim |

|

The fund aims to provide positive investment returns over a rolling 3-year period in all market conditions by investing in securities globally, using Financial Derivative Instruments where appropriate, with a volatility level typically lower than two-thirds of the MSCI All Country World Index (Total Return Net). A positive return is not guaranteed over this, or any time period and a capital loss may occur. |

The fund aims to provide positive investment returns over a rolling three-year period in all market conditions by investing globally in a portfolio that is positioned towards securities with positive environmental, social and governance (ESG) characteristics, using derivatives where appropriate. |

| Old investment process | New investment process |

|

The fund will primarily invest in Debt Securities (which may include Below Investment Grade Bonds and Unrated Securities), Convertible Bonds, Equity securities (which may include smaller companies) and short-term securities. The Investment Manager seeks to achieve the stated targets / objectives. There can be no guarantee the objectives / targets will be met. |

The manager uses an investment process based on macro research to identify global investment themes and opportunities. It is a flexible and focused approach to take advantage of global trends and changes through traditional and non-traditional assets. A fully integrated, risk management framework provides detailed portfolio analysis. The fund invests in securities exhibiting positive ESG characteristics by adhering to ESG exclusions and positioning the portfolio towards issuers with positive ESG characteristics. |

Please note that fund charges remain the same.

Changes to the RLP / Fidelity Sustainable Emerging Markets Equity fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP / Fidelity Sustainable Emerging Markets Equity fund have been clarified as per the table below:

| Old aim | New aim |

|

The fund aims is to achieve long term capital growth. |

The fund aims to achieve long term capital growth |

| Old investment process | New investment process |

|

The fund will invest at least 70% in equities (and their related securities) of companies having their head office or exercising a predominant part of their activity in Emerging Markets globally including Asia, Latin America, Europe, Middle East and Africa according to the MSCI Emerging Markets (Net Total Return) Index and which maintain sustainable characteristics. The fund is actively managed. The Investment Manager identifies suitable opportunities for the fund utilising in-house research and investment capabilities. The fund aims to hold a concentrated portfolio, investing in 30-50 companies or other types of investment. |

The fund invests at least 70% of its assets in equities of companies that are listed, headquartered, or do most of their business, in developing markets including countries in Latin America, Asia, Africa, Eastern Europe and the Middle East. The fund may also invest in money market instruments on an ancillary basis. The fund invests at least 70% of its assets in securities of companies with favourable environmental, social and governance (ESG) characteristics and up to 30% in securities of issuers with improving ESG characteristics. The fund will invest less than 30% of its assets (directly and/or indirectly) in China A and B Shares (in aggregate). The fund invests in a limited number of securities (generally between 20 to 80 under normal market conditions). The manager aims to outperform the benchmark. In actively managing the fund, the manger considers growth and valuation metrics, company financials, return on capital, cash flows and other measures, as well as company management, industry and economic conditions, and other factors. It also considers ESG characteristics when assessing investment risks and opportunities. In determining favourable ESG characteristics, the manager takes into account ESG ratings provided by Fidelity or external agencies. |

Please note that fund charges remain the same.

Changes to the RLP Pacific Tilt fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Pacific Tilt fund have been clarified as per the table below:

| Old aim | New aim |

|

The fund aims to deliver returns in line with the benchmark, whilst reducing its carbon intensity and improving the ESG and Responsible Investment profile, relative to the benchmark. |

The fund aims to deliver returns in line with the benchmark, while looking to achieve carbon intensity of at least 30% lower than that of the Index and considering a company’s ability and willingness to transition and contribute to a lower carbon economy. |

| Old investment process | New investment process |

|

The fund invests in equities from all economic sectors within the Pacific region - mainly Japan, Hong Kong, Singapore and Australia. |

The fund primarily invests in equities from all economic sectors within the Pacific region - mainly Japan, Australia, Taiwan, South Korea, Hong Kong, and Singapore. Responsible investment and environmental, social and governance insights are incorporated into the investment process. |

Please note that fund charges remain the same.

Changes to the RLP Japan Tilt fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Japan Tilt fund have been clarified as per the table below:

| Old aim | New aim |

|

The fund aims to deliver returns in line with the benchmark, whilst reducing its carbon intensity and improving the ESG and Responsible Investment profile, relative to the benchmark. |

The fund aims to deliver returns in line with the benchmark, while looking to achieve carbon intensity of at least 30% lower than that of the Index and considering a company’s ability and willingness to transition and contribute to a lower carbon economy. |

| Old investment process | New investment process |

|

The fund invests in the shares of Japanese companies from all economic sectors. From time to time, the fund may invest in cash and other investments the manager considers appropriate. |

The fund invests in the shares of Japanese companies from all economic sectors. From time to time, the fund may invest in cash and other investments the manager considers appropriate. Responsible investment and environmental, social and governance insights are incorporated into the investment process. |

Please note that fund charges remain the same.

Changes to the RLP Global Sustainable Equity fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Global Sustainable Equity fund have been clarified as per the table below:

| Old aim | New aim |

|

The fund’s performance target is to outperform, after the deduction of charges, the MSCI All Countries World Net Total Return Index GBP (the “Index”) by 2.5% p.a. over rolling 3-year periods |

The fund's performance target is to outperform, after the deduction of charges, the MSCI All Countries World Net Total Return index GBP by 2.5% a year over rolling three-year periods. Investments in the fund will adhere to the manager's ethical and sustainable investment policy. |

| Old investment process | New investment process |

|

The fund invests in a limited number of companies from developed and emerging markets that the fund manager believes can create wealth for shareholders but are currently undervalued. Suitable companies are identified by first using in-house screening tools to reduce the investment universe of 3,000+ shares to around 600 that the fund manager believes have the potential to create shareholder wealth. A "deeper dive" analysis is then performed to identify what they believe to be the very best, attractively priced companies for investment. The fund focuses on the sustainability of the products and services of the companies it invests in as well as their standards of environmental, social & governance (ESG) management, alongside financial analysis. The fund manager avoids investing in tobacco and armament manufacturers, nuclear power generators, and companies that conduct animal testing (other than for purposes of human or animal health and/or where it is required by law or regulation). This exclusion policy helps to avoid companies the fund manager believes expose investors to unacceptable financial risk resulting from poor management of ESG issues. |

At least 80% of the fund will be invested in the shares of companies globally, both in developed and emerging markets. These will be companies that are deemed to make a positive contribution to society. The fund may invest up to 10% in other investment funds, known as collective investment schemes. The fund may invest up to 20% in other transferable securities, money market instruments, cash, and deposits. The fund may use derivatives, but for efficient portfolio management purposes only. The fund focuses on the sustainability of the products and services of the companies it invests in, as well as their standards of environmental, social and governance (ESG) management, alongside financial analysis. The manager avoids investing in tobacco and armament manufacturers, nuclear-power generators, and companies that conduct animal testing (other than for purposes of human or animal health, and/or where it is required by law or regulation). This exclusion policy helps to avoid companies the manager believes expose investors to unacceptable financial risk resulting from poor management of ESG issues. The fund’s ethical and sustainable investment policy may change from time to time to reflect new developments and research in the field of sustainable investment. |

Please note that fund charges remain the same.

Changes to the RLP Far East (Ex Japan) Tilt fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP Far East (Ex Japan) Tilt fund have been clarified as per the table below:

| Old aim | New aim |

| The fund aims to deliver returns in line with the benchmark, whilst reducing its carbon intensity and improving the ESG and Responsible Investment profile, relative to the benchmark. | The fund aims to deliver returns in line with the benchmark, while looking to achieve carbon intensity of at least 30% lower than that of the Index and considering a company’s ability and willingness to transition and contribute to a lower carbon economy. |

| Old investment process | New investment process |

| This equity fund invests in companies in the Far East, excluding Japan. The manager takes the view that key economic indicators for global economic activity have a strong effect on this market place and therefore follows the global and Pacific region markets closely. | This equity fund invests in companies in the Far East, excluding Japan. The manager takes the view that key economic indicators for global economic activity have a strong effect on this marketplace and therefore follows the global and Pacific region markets closely. Responsible investment and environmental, social and governance insights are incorporated into the investment process. |

Please note that fund charges remain the same.

Changes to the RLP American Tilt fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLP American Tilt fund have been clarified as per the table below:

| Old aim | New aim |

| The fund aims to deliver returns in line with the benchmark, whilst reducing its carbon intensity and improving the ESG and Responsible Investment profile, relative to the benchmark. | The fund aims to deliver returns in line with the benchmark, while looking to achieve carbon intensity of at least 30% lower than that of the Index and considering a company’s ability and willingness to transition and contribute to a lower carbon economy. |

| Old investment process | New investment process |

| The fund manager will invest primarily in the constituents of the FTSE USA Index, which consists of North America's leading companies. | The fund manager will invest primarily in the constituents of the FTSE USA Index, which consists of North America's leading companies. Responsible investment and environmental, social and governance insights are incorporated into the investment process. |

Please note that fund charges remain the same.

Changes to the RLL American Tilt fund – 31 May 2024

Effective from 31 May 2024, the wording of the Investment Aim and Investment Process of the RLL American Tilt fund have been clarified as per the table below:

| Old aim | New aim |

| The fund aims to deliver returns in line with the benchmark, whilst reducing its carbon intensity and improving the ESG and Responsible Investment profile, relative to the benchmark. | The fund aims to deliver returns in line with the benchmark, while looking to achieve carbon intensity of at least 30% lower than that of the Index and considering a company’s ability and willingness to transition and contribute to a lower carbon economy. |

| Old investment process | New investment process |