Market volatility: what it means and how to navigate it

While it can be alarming to see your investments fall in value, it’s important to be aware that market ups and downs are a normal part of investing. And, over the long term, even with market downturns, investing can still help you reach your financial goals.

It's important to remember though that the value of investments can go down as well as up, and you may get back less than you paid in.

What is market volatility?

Very simply, in this context, volatility means sharp movements in markets. So, although you’ll tend to hear more about market volatility during downturns, it also includes periods where investments rise rapidly and sharply.

What causes market volatility?

Volatility can be caused by multiple things, including:

- Political instability

- Global events, such as the pandemic

- Releases of economic data such as how fast a country's economy is growing

- Interest rate decisions

- Company performance figures

- Trade disputes.

Should I worry about market volatility?

There’s no doubt it’s uncomfortable seeing the value of your investments fall but, historically, we’ve seen most markets rise in value over the long term.

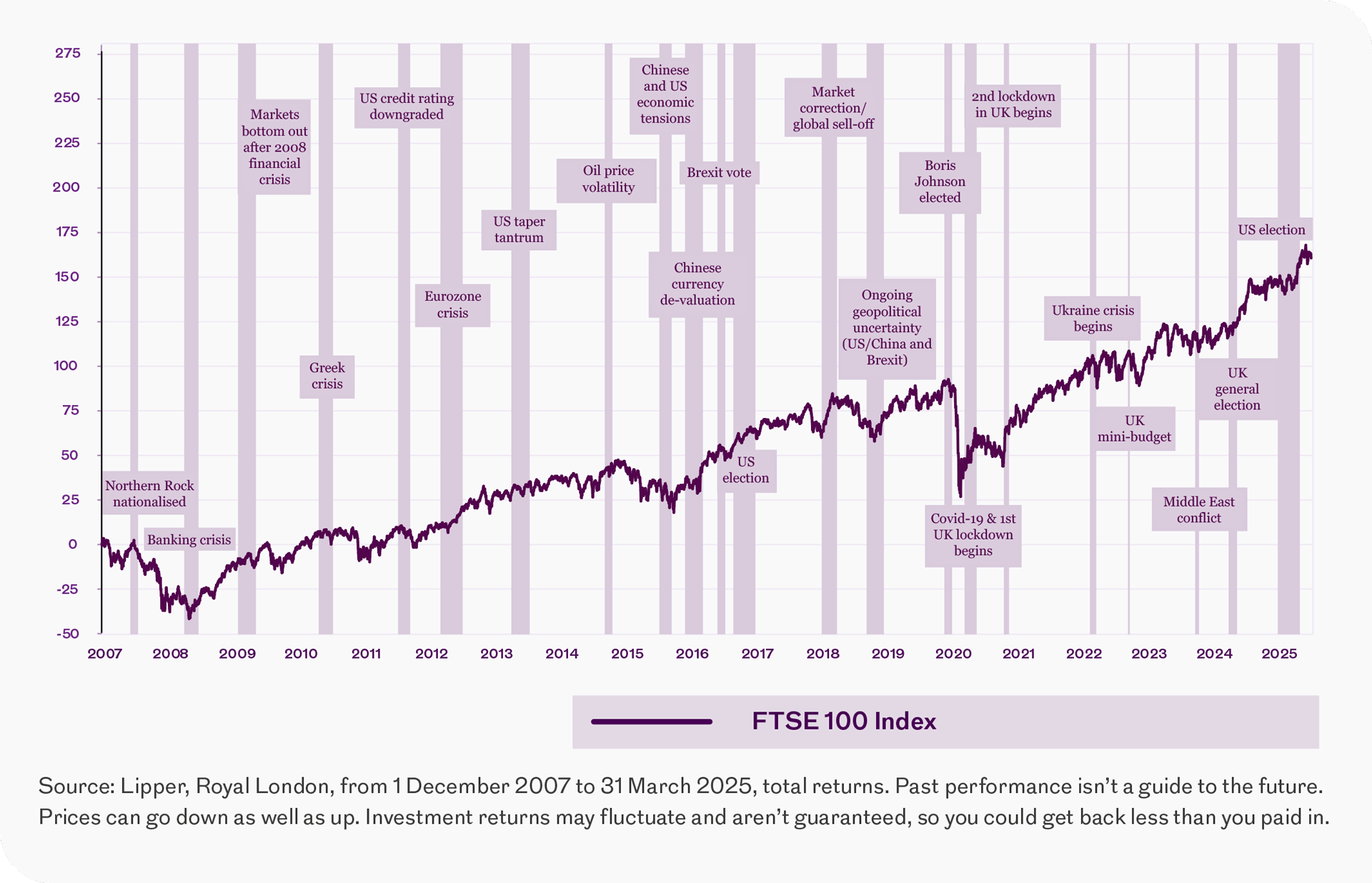

As just one example, take the FTSE 100 Index, which covers the shares of the UK’s 100 biggest companies. Looking at its value between January 2007 and December 2024, it fell around the time of the financial crisis of 2007-2009, the Brexit vote in 2016 and during the pandemic from 2020 – sometimes dramatically.

This is just one example and past performance isn't a guide to future performance. But, despite some significant downturns, the FTSE 100 Index's overall value increased over this period, with gains significantly outweighing losses, as you can see in the chart below.

What does volatility in the markets mean for me?

The impact of market volatility depends on where your money is invested. For example, equities (stocks and shares) are generally considered riskier investments than bonds and property. So, if a high proportion of your money is invested in equities, during periods of market volatility you’re likely to see bigger falls in value than if you had a high proportion in bonds and property. Remember though that past performance isn’t a guide to future performance and all investments can go down as well as up.

If you're invested in one of our Governed Range options, your money is in portfolios designed to navigate turbulent periods in markets by holding a mix of different types of investments, including equities, bonds and property. This diversified approach has played an important role in lessening the impact of volatile markets since the launch of the range in 2009.

Markets have fallen and I want to access my pension savings soon – should I be worried?

If you’re planning to take money from your pension savings soon, firstly check how your pension is invested.

If you’re in a workplace pension, you may be invested in a lifestyle strategy. These are designed to reduce risk as you get closer to retirement by moving your pension savings into investments which have historically been less risky, such as bonds.

Whether or not volatility has had an impact on your investments, you're likely to find it beneficial to either get guidance from the Government’s Pension Wise service or advice from a financial adviser about your personal situation before starting to take money from your pension savings.

I’m retired and already taking money from my pension – how will market volatility affect me?

The impact of market volatility after retirement, when you're taking your pension savings, depends on where you’re invested, as well as how much money you’re taking out. So it’s a good idea to take financial advice to make sure what you do reflects your individual circumstances.

Generally, taking money out when markets are falling could increase the risk of your pension savings running out sooner than expected. This is because you’ll have a smaller pot that offers less opportunity to recover from any losses.

If you’re invested in lower-risk options, you may not be affected as much as if you were invested in higher-risk options. However, while a lower-risk portfolio may offer greater security during market downturns, it does tend to mean lower longer-term returns. So you may miss out on growth when markets recover.

If you’re thinking of making any changes to your pension investments or withdrawals, we recommend you get guidance or advice before making any decisions.

Should I move to investments with less risk?

All investments carry some level of risk. However, it’s important to choose investments with a level of risk that you’re comfortable with and that will help you meet your long-term goals.

If you’ve reassessed your attitude to risk and want to reduce the amount of risk you’re taking with your investments, think about getting guidance or advice before making any changes. While you may be tempted to move out of falling investments, if you do, you’re not only locking in losses, you’re also potentially missing out on any recovery in the value of those investments. And remember that lower-risk investments are more likely to provide lower long-term returns.

What should I do when markets are volatile?

If you’re concerned about market falls, here are some general points to think about.

Don’t panic and take a long-term view

There’s no denying that market downturns can be incredibly worrying, but the most important thing is not to panic and make any hasty decisions. Downturns happen, but markets do tend to eventually recover, offering long-term investors time to make up losses.

Of course, past performance isn't a guide to future performance. However, if you can stay the course during periods of volatility and take a long-term view, you're likely to see the value of your investments increase over time.

While you may be tempted to move out of falling investments, if you do, you’re not only locking in losses, you’re also potentially missing out on any recovery in the value of those investments. Continuing to buy investments, for example continuing to pay regular contributions into your pension or ISA, is generally a good idea too. This is because market downturns give you the opportunity to buy more investments at a cheaper price.

Check how much risk you’re comfortable and able to take

Are you still comfortable with the amount of risk you're taking with your investments? If you're not comfortable seeing large falls in value during periods of market volatility, you might want to think about moving into lower-risk investments once markets recover.

You can find out if your attitude towards risk has changed since you started investing using our risk profiler tool.

As well as thinking about how much risk you're comfortable taking, you should think about how much risk you're able to take. This is sometimes called your 'capacity for loss' and basically means how much money you can afford to lose. If you can't afford to lose much, again, lower-risk investments might be the best option for you.

All our Governed Range options have a risk level, so you can choose the one which most closely matches how much risk you're comfortable and able to take.

If you're not sure what's the right course of action for you, always consider getting professional advice.

Check your investments are diversified

Diversification involves spreading your money across different types of investments and geographical locations. This can help reduce the amount of risk you take and potentially smooth out the returns you get on your investments, which in turn can help lessen the impact of market volatility.

If you’re invested in one of Royal London’s Governed Range options – a Governed Portfolio, a Governed Retirement Income Portfolio or a lifestyle strategy – you'll already be in a diversified investment option.

Get advice

Everyone is different, which is why you should think about getting financial advice tailored to your own personal situation. This is particularly beneficial during market downturns.

An adviser can help give you reassurance that you’re making the right decisions, both in the short and longer term, especially if you’re approaching retirement and will need access to your money soon.

If you don’t have an adviser, here's how to find one.