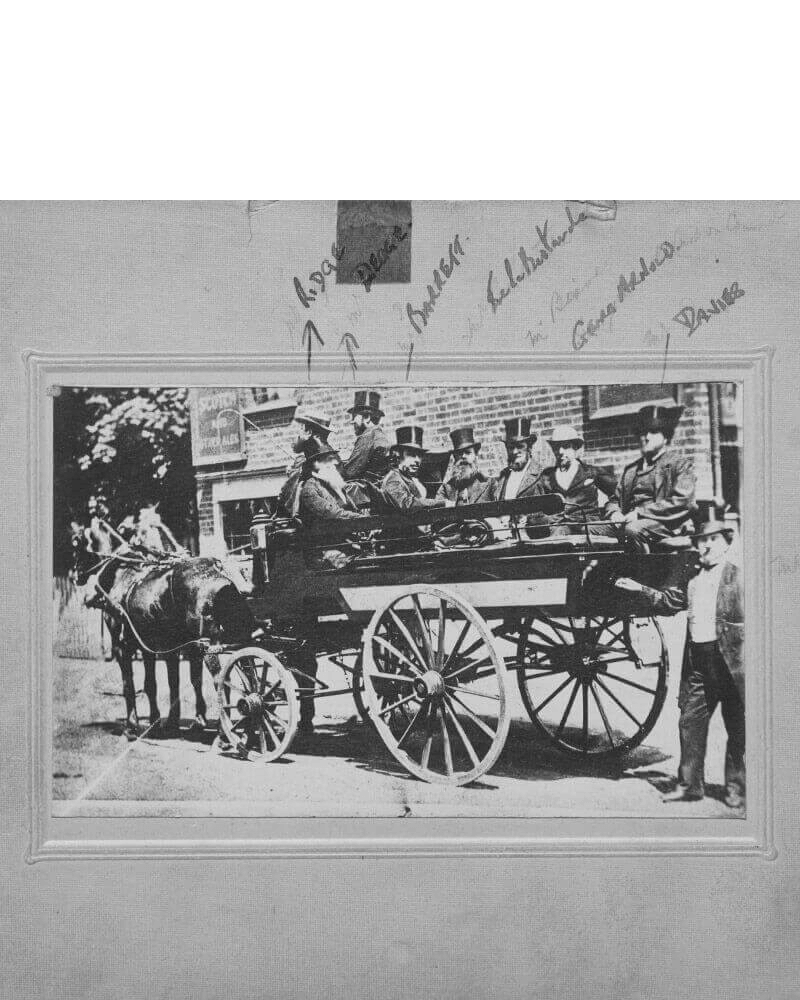

Our Committee of Management, including our founders, out and about in the 1860s.

Our story

It began in Victorian Britain, a time where people who couldn’t afford a proper burial would receive what was known as a pauper’s funeral – a basic affair organised by the local parish.

Back then a burial like this was seen to be the ultimate disgrace. So even the poorest people would contribute to a local burial club to avoid a pauper’s funeral at all costs.

Burial clubs eventually became Friendly Societies, and in February 1861, two men named Joseph Degge and Henry Ridge met in London (tradition has it) in a coffee house on City Road, to discuss the formation of a new one.

By the end of that meeting, they’d agreed to form a business that they imagined calling the Royal London Life Insurance and Benefit Society, which was ultimately registered in April 1861 as The Royal London Friendly Society.

Proud to be mutual

As the business grew, the decision was made in 1908 to convert from a Friendly Society to a mutual, and we’ve remained that way ever since.

Today, Royal London is the largest mutual life, pensions and investment company in the UK, and in the top 30 mutuals globally*, with assets under management of £173bn, 8.7 million policies in force and over 4,500 employees. Figures quoted are as at 31 December 2024.

Mutual companies like Royal London are customer-owned and it influences the decisions we make every day.

*Based on total 2022 premium income. ICMIF Global 500, 2024