UK workers trust their employer and expect them to help with retirement planning

- More than two thirds (68%) of workers trust their employer, making it the third most trusted institution among individuals in the UK, after their own family and bank

- A quarter (23%) of individuals see their employer as one of their greatest sources of guidance for long-term financial planning

- Individuals increasingly lean on social media, with one in seven (13%) looking to social platforms for information on their pension

Building on 10 years of Auto Enrolment, a new report from mutual pensions and insurance provider, Royal London, shows the central role employers continue to have in helping improve their workers’ retirement outcomes.

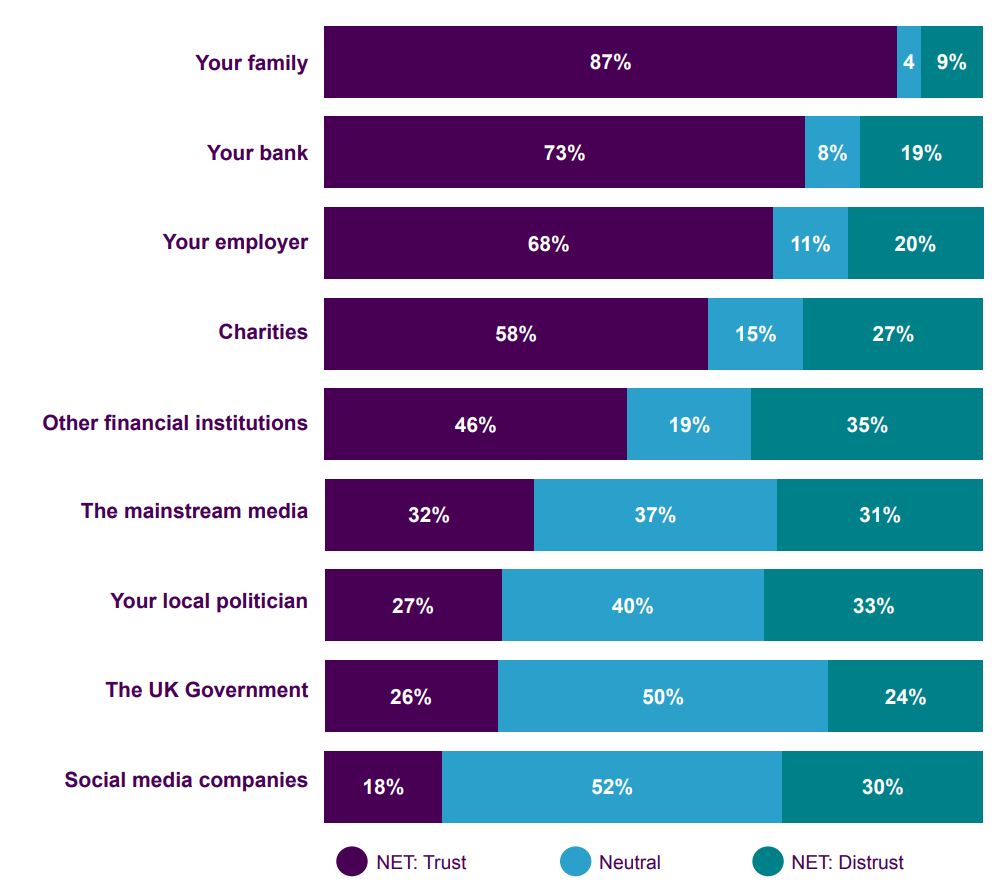

The research suggests that the relationship between a worker and employer goes beyond the simple exchange of a payslip at the end of the month. More than two thirds of workers (68%) rank their employer as a trustworthy institution, making it the third most trusted after their own family (87%) and bank (73%). This is even higher for young adults, with those aged 18-34 ranking their employer and their bank equal second in terms of trust (72%). By contrast, the UK Government (26%) and social media firms (18%) are the least trusted amongst those surveyed.

After someone’s own family and bank, employers are the third most trusted institution among individuals. The government and social media firms are least trusted.

Trust in employers has meant that many individuals now rely on their employer to help shape their retirement savings approach. A quarter (23%) of employees consider their employer a great source of guidance for their pension, after family and friends (35%) and professional advice (28%). What’s more, employees are happy to discuss financial matters with their employer with more than half (54%) saying they would be comfortable having a conversation about money with the organisation they work for.

Growing popularity of social media guidance

The use of social media for retirement planning is on the rise with one in seven (13%) workers looking to social platforms to help inform their retirement needs. This increased to more than one in five (22%) for those aged 18-34-years, suggesting early engagement from young adults with their long-term savings. Individuals are primarily turning to Facebook (59%), Instagram (54%) and TikTok (39%) to find out how much they need to save.

Unsurprisingly, reliance on social media varies significantly between generations with only 3% of those aged 55 and over seeking retirement information on social media. Instead, individuals over the age of 55 favour discussions with professional advisers: one in three (33%) have used an adviser to help them understand how much they will need in retirement, and two in five (39%) consider professional advice the greatest source of guidance for long-term financial planning.

These findings demonstrate that the worker-employer relationship is key, with employers well placed to help workers through their retirement journey by providing greater engagement with workplace pension arrangements. Almost three in ten (29%) workers who are part of a workplace plan do not recall receiving any pension information from their employer in the last 12 months, showing that communication and engagement in this area are still lacking.

Commenting on the findings, Clare Moffat, pensions expert at Royal London, said:

“Employers should reflect on the fact that many of their employees trust and value their guidance when it comes to long-term financial planning.

“Whilst social media can be great at amplifying the conversation on retirement planning, and encouraging people to engage with their savings, you should not exclusively rely on it to help plan for your future.

“Employers’ clear position of influence shows they too are seen by employees as a good source of retirement guidance. They should be driving pensions awareness and understanding amongst their workers to help them achieve the retirement lifestyle they want.

“Encouraging workers to continue saving is now more important than ever given the current cost of living challenges. Making cutbacks to regular pensions contributions may seem like a necessary option in the short-term but these contributions should be restarted as soon as it’s financially possible. Reducing or stopping contributions now will mean that you have less to live on in retirement or that you’ll have to retire later than planned.”

For further information please contact:

Maria Da Costa, Senior Communications Consultant

Notes to editor

Royal London partnered with independent research agency Cicero/AMO to undertake a nationally representative survey of 3,042 adults in the UK. Fieldwork was conducted between 13 – 24 May 2022.

Royal London’s ‘The Future of Auto Enrolment’ report can be read here.

About Royal London

Royal London is the largest mutual life, pensions and investment company in the UK, with assets under management of £147 billion, 8.7 million policies in force and 4,232 employees. Figures quoted are as at 31 December 2022.

Learn more at royallondon.com