The Royal London guide to going self-employed

This guide is designed to help people who may be considering leaving paid employment to work for themselves. It may also prove helpful to those whose employment status has changed as a result of the pandemic.

It explains the challenges of taking charge of your own income and working patterns, as well as looking at some of the gaps in your finances that you will need to fill.

Topics covered include:

- The different types of self-employment

- Will you be a sole trader or set up your own company? The pros and cons of each.

- How to plan and budget before you take the plunge

- Savings and the self-employed – what are your options for short-term and long-term savings? How much should you save?

- Cash flow management and budgeting for the self-employed, especially when invoices go unpaid.

- How to work out what you need to earn

- How much will you earn as a self-employed person, and what costs do you have to meet out of those earnings?

- Tax and self-employment

- What are the implications for how and when you pay tax?

The guide also looks at some of the ways that being self-employed can affect other big financial decisions, like getting a mortgage or starting a family.

Introduction

The coronavirus crisis may have changed forever how we view self-employment.

Before the pandemic, working for yourself was considered a way to live out your dreams. The idea of being your own boss, working when you want, and focusing on things of personal interest appealed to millions of people seeking a better work/life balance.

At the last count, according to the Office for National Statistics some 4,374,000 people in the UK were self-employed, working in all corners of the UK economy.

Before the pandemic, that number was rising, partly as people made a conscious and deliberate choice to become masters of their own destinies but also partly, sadly, because they couldn’t find suitable paid, permanent employment.

Now, after more than a decade of continuous growth, the total number of self-employed has fallen by more than half a million in just a year as workers seek more financial security. For some, it may be that a big impetus to become self-employed – the ability to work from home – has gone as homeworking becomes the new normal, regardless of employment status.

Nevertheless, for many people, self-employment remains the only alternative to unemployment in an economy with fewer paid jobs and minimal benefit support.

If a decision to go self-employed is one you are currently facing, for whatever reason, this guide is for you.

Things to think about

While the benefits of being your own boss are clear, perhaps even more so if you have been working from home for months, there are some important practical things to consider before you make the leap. Some are less obvious than others.

Some you have probably considered:

- Have I got a decent place to work from?

- Have I got the right equipment, i.e. laptop, printer, decent broadband connection etc?

- Should I be a freelancer or set up as a limited company?

- Do I know who my potential clients are and are they likely to buy my services?

Some things you might not have considered:

- If you are only paid when you work (‘time is money’) can you ever switch off?

- What happens when invoices are not paid promptly – or not at all?

- What do you do if dependants are off sick?

- What happens during school holidays (or if home-schooling is necessary)?

- What happens when you can’t work because of sickness or maternity? Can you afford time not working?

- What are the hidden costs of self-employment?

- Should you have a ‘target’ level of income – how much is 'enough'

- How much time will you have to spend on ‘admin’ – building websites, dealing with accountants, marketing your services?

- Will your home start to feel like your workplace? How do you stop that from happening?

And last but not least…

- How can you save enough for retirement if you don’t have an employer paying into your pot?

That last point is a particularly big deal. It is estimated that about seven in ten self-employed people do not currently save into a pension for their retirement, according to the Money Advice Service, prompting claims that people who work for themselves are walking into a crisis when they stop working.

That’s because, unlike employed workers, the self-employed are not auto-enrolled into a scheme and do not benefit from employer contributions to their pension. Irregular cash flow can also make regular deposits into a pension more difficult.

The good news is that none of these obstacles are insurmountable.

The less good news is that it might take more planning than you’d imagined to make sure you’ve got everything covered.

Background – Who are the self employed?

There are 4,374,000 self-employed people in the UK, according to the ONS. A decade ago that number was 3.78 million 1.

Their occupations and working lives are as wide and varied as the rest of the employment market, so talk of the self-employed as a homogenous group is misleading.

However, as a group, self-employed people tend to be less financially resilient because of fluctuating demand for services, cash flow and lack of a safety net. They have struggled disproportionately during the pandemic: the shutdown of the economy and the way the Government has structured support has been particularly hard for those working for themselves.

Earnings: employed versus self-employed

In general, self-employed people tend to earn less than their employed counterparts overall and that’s partly because they might be more likely to work part-time: around one-third of self-employed people are part-time.

Which industries have the most self-employed people?

There are more self-employed people in the construction industry (nearly one fifth of all self-employed people) and professional and other services sectors than in other areas of the economy.

The difference between these two sectors highlights the range of skills and qualifications within the self-employed worker bracket.

What age do people become self-employed?

The proportion of self-employed young workers - as well as older people choosing to go it alone - is rising more quickly than those in the middle age groups.

The number of 16 to 24-year-olds in self-employment has risen by around a quarter in the past decade, while the number of those aged 65 plus who count themselves as self-employed has almost doubled.

There are more and more young people who have never had a paid job. According to the Resolution Foundation,[1] 8.2 per cent of the workforce aged 16 to 64 have never had a paid job - 3.4 million people - a 52 per cent increase since 1998, when 5.4 per cent had never worked.

Among those aged between 25 and 64, the proportion of self-employed people is also rising, but the biggest increases are at the beginning and end of the working age spectrum.

The nature of the work of these older and younger self-employed people is likely to be very different.

The more experienced older workers, with decades of network-building and skills behind them, may enjoy the fruits of being more established through higher pay and better working terms, the ability to ‘call the shots’ more, and feel in demand.

Younger self-employed workers may be more likely to feel like they have to prove themselves, chasing work and sometimes accepting compromises in order to get paid.

“Individuals, particularly the self-employed, gig economy workers and those on zero-hours contracts are suffering from unevenly distributed pay and a lack of clarity on their employment rights.”

Quote: Matthew Taylor, chief executive of the RSA (Royal Society for arts, manufactures and commerce)

Are more women or men self-employed?

There is another important trend: more women are becoming self-employed, according to the Office for National Statistics (ONS).

In particular, this includes mothers who try to fit work around children.

Self-employment gives this time-strapped group, juggling a myriad of other demands, a way to earn money and retain a career. But it can also mean missing out on some of the important benefits of having a job, such as:

- sick pay

- holiday pay

- some types of insurance, like life insurance

- pensions

All of these are especially valuable when you have dependants who might also be sick, be on holiday from school, require private medical care, and so on.

There are different kinds of self-employment, too. The type you choose might depend on the availability of work.

Different types of self-employment - what suits you best?

The type of work you take on will determine the shape of your working life.

There are self-employed workers who have two or three jobs or contracts on the go at the same time, juggling by the hour, and others who concentrate on one project for a few months or years, then move onto the next.

The former can be an exciting and stimulating way to work but it involves lots of time management and logistics; the latter can offer more security of cash flow for a period of time, but runs the risks of gaps in between projects, where you can risk running out of money.

Here are the main types, as well as some pluses and minuses for each:

Contract-based

Contract workers are self-employed but usually on fixed term contracts (of a set number of months/years), or contracts that offer a set number of hours/days a week of regular paid work, from a client.

This can be a bit like being employed, with some contracts lasting several years and then being renewed.

Before the pandemic, the Government was in the throes of a crackdown on some types of contract worker, considered ‘pseudo’ self-employment, (sometimes called ‘practically employed’). This is where a self-employed person is treated like an employee, but without the employer having to meet pension, PAYE or other obligations to the contractor in the way they would if they were fully employed. It can also mean that the contractor pays less tax and National Insurance. The rules around this kind of ‘off-payroll’ working are called IR35 and you can find more information on the Government website here. At the time of writing this guide, IR35 tax reforms were due to come into effect in April 2021.

Advantages of contract work:

- Regular pay

- Future security of cash flow for as long as that contract lasts

- Depending on the number of hours per week, a contract means you can still take on other work

- Often regular days worked each week, making planning relatively easy

- Often a higher day rate is offered than you would be paid in traditional employment

Disadvantages of contract work:

- You have to pay your own tax (no PAYE) through annual self-assessment tax returns

- You have to find new work when the contract ends

- Contracts can often be terminated at relatively short notice

- No holiday or sick pay (although if you have been a contractor for a long time, your client may still offer to pay you sick pay)

Good for you if:

- You like the regularity of traditional employment and are happy to manage your own tax affairs and cash flow over periods of non-work, such as holidays and periods between contracts

Think twice if:

- You would prefer to work on a variety of different jobs at one time and do not like having set hours

‘Zero-hour’ contracts

You might also have heard of contracts called ‘zero-hour’ which require the employee to be ready to work at very short notice and ready to stop work also at short notice, with no knowing when they will next be needed. This type of contract is not classified as self-employed but known as ‘non-standard’ employment.

Advantages of ‘zero-hour’ contracts:

- In theory, it is possible to fit these jobs around other commitments, such as study - this is one reason why zero-hour contracts are commonly offered by retailers or other employers who tend to employ students

- A chance to get a foot in the door

- Can be terminated by the worker at short notice if they find another job

Disadvantages of ‘zero-hour’ contracts:

- No job security

- No fixed income month to month

- No holiday or sick pay

- Can be terminated at short notice

Good for you if:

- You have other time commitments but want to earn some cash in your spare hours

Think twice if:

- You need regular income to cover bill payments

- You need to plan ahead, such as arranging childcare well in advance

Commission-based

This refers to where a freelancer, consultant or other type of self-employed worker accepts individual commissions for small or large pieces of work.

Advantages of commission-based work:

- ‘Fingers in many pies’ – boosts experience and networks quickly

- Exciting and stimulating doing a number of jobs at the same time

Disadvantages of commission-based work:

- The logistics of doing many different jobs at the same time can be challenging

- Lack of predictability/control over timing and nature of work requests

Good for you if:

- You like variety and like to manage your own time and place of work

- You are organised

- You like to network and promote yourself

Think twice if:

- You find it hard to manage multiple tasks at once

- You prefer to see projects through from start to finish

Different types of self-employment - which one is right for you?

There are also different ways of setting yourself up, for tax and legal purposes.

However, there are many considerations beyond tax and the law which will determine your next steps, including:

- How you want to be perceived by potential clients and partners

- Future plans for growth

- Appetite for administrative work

- Appetite for risk

- Whether you want to employ other people

Here are the main structures, along with the main advantages and disadvantages of each.

Sole proprietor / Sole trader

A sole trader is someone who is the only owner of a business and is legally entitled to keep the profits (but is also liable for all the losses).

Some advantages of being a sole trader are:

- It’s easier to manage tax-related admin, as it is restricted to a self-assessment tax return

- You do not need to set up a separate business bank account (although you might still want to)

Some disadvantages of being a sole trader are:

- You shoulder the risk of loss personally

- If your business and personal outgoings and income are mixed up in one account, this can become confusing

Limited company

A company limited by shares (you can decide the number of shares to issue and how they are split when you register your new company at Companies House).

One person can be the only director of a limited company, but usually there are two or more share owners in a limited company.

Some advantages are:

- The business and you are treated separately under law. So if there are business debts, this does not affect your credit score. Your personal assets, such as your house or car, are not at risk

- If you want the business to grow and potentially take on a life of its own without you, then a limited company structure makes it easier to transfer ownership, through selling shares

Some disadvantages are:

- The filing of company accounts in addition to your personal tax return increases the burden of admin

- You will be taxed differently as you will pay corporation tax, usually draw a minimal salary up to the personal allowance threshold, then draw the rest of your income as dividends. This can result in a lower overall tax burden but more complicated finances

- It may be advisable for you to leave a ‘float’ of cash in the business to cover unexpected costs or bills. This means you may have to generate more revenue than you would if you were a sole trader

- You might require the services of an accountant to help you with tax

Partnership

For when you are setting up a business with one other person or more, partnerships are an alternative to limited companies.

Some advantages are:

- No need to register with Companies House or file returns

- Control over the structure of the partnership, roles and responsibilities

- Possible tax advantages as income is drawn as a share of profits – there’s no need to set up a PAYE salary

Some disadvantages:

- With traditional partnerships, you and other partners share personal liability for any business debts

- Income taxed as personal income

Limited liability partnership

A combination of a limited company and partnership, with limited liability partnerships the business debts cannot become personal, but you can still share the profits between partners.

Some advantages are:

- As above, business debts cannot become personal ones

- Partners can be companies as well as individual members

- Partners are required to put in the cost of capital but can take a share of the profits

Some disadvantages are:

- Income taxed as personal rather than business income

- Accounts have to be filed at Companies House

Money and the self-employed

A) How much will you earn as a self-employed person, and what costs do you have to meet out of those earnings?

This bit is really important.

When you are calculating what you need to earn as a self-employed person, you have to bear in mind the value of any employee benefits you currently receive from your employer. If you still want to avail yourself of these or similar benefits when you are self-employed, you will in all likelihood have to earn more per day than you do as a salaried employee.

Some of the most valuable employee benefits relate to paid leave:

- Holiday pay

- Sick pay

- Maternity/paternity pay

- Parental leave

- Carer’s leave

- Bereavement pay

There are other major benefits that often come as part of the package, or are seriously discounted for employees:

- Employer contribution matching on a workplace pension (an effective pay rise)

- Life insurance as a multiple of salary

- Health insurance (usually through salary sacrifice)

- Cycle to work (also usually salary sacrifice)

These are all things that many employees take for granted, but they cannot be taken for granted when you go it alone: you must shoulder the ‘cost’ of these, if you want them, by yourself.

What is the value of what you forego – and what would you have to pay to replace them yourself?

Again, this is not a straight swap as often things like health insurance premiums are higher if you are self-employed than if you are a part of a bulk-bought deal through an employer.

We’ve broken the value of these benefits down, plus the cost of replacing them, based on the average UK full-time employee salary of £30,000 to give you an idea of the extra amount beyond your current earnings that you would need to earn in order to cover them yourself (for background, in 2019, median annual earnings were £30,378; in 2020 the figure was £31,461, according to Statista, a data company).

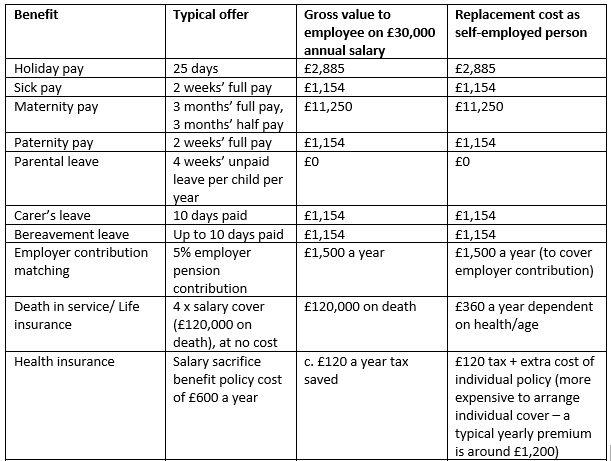

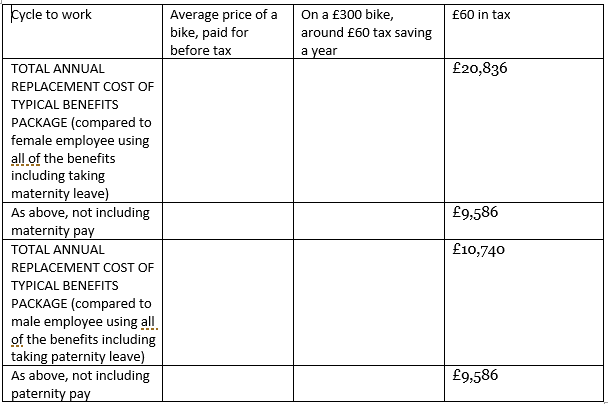

Fig 1.1 The typical value of employee benefits and what it would cost to replace them if you are self-employed:

NB. Typical doesn’t mean the legal statutory minimum, but what large employers typically offer to staff as part of a benefits package.

Of course, it would be unlikely you would be claiming all of these benefits in a single year, with things like maternity or paternity pay only likely to be claimed once or twice. If you had to claim carer’s leave and bereavement leave up to the maximum number of days that would also be unlucky. More likely, you would claim this leave a couple of times in your working life.

Nevertheless, removing the one-off benefits and looking just at holiday pay, sick pay, employer pension contributions, life insurance policy payments, health insurance policy payments and tax savings, the extra cost of providing all of these things for yourself in a year could be around £7,200.

So the employed day rate for someone on £30,000 is £115 a day. If you were to go self-employed at the same level, you would need to earn almost £28 per day extra to cover the loss of all the paid benefits you had before, such as holiday pay and sick pay.

If you wanted to take more holiday days than you had before, you’d have to increase this day rate.

If you want to take time off for children, you’d have to increase this by a significantly greater amount for those years.

A) Savings and the self-employed – what are your options for short-term and long-term savings?

If you are planning to go self-employed, tempted though you may be to jack-in a job you have fallen out of love with overnight, give yourself some months to build up some savings before you take the leap.

This patience will reap dividends in terms of your confidence to hold out for work you want and reject lower value work, and for your stress levels.

The more you have in reserve, the less likely you are to succumb to the pressure to work all hours to make ends meet, or to take work that may not be the work you want in order to make ends meet.

How much do I need to save?

The typical guidance for everyone, whether self-employed or not, is to have three to six months’ worth of income in an emergency savings pot that can be accessed instantly, when it is needed.

For self-employed people, the need for this ready pool of cash is greater as there may be ‘void periods’ between contracts or freelance work, or a year or two where you earn less because, for example, you’ve had to care for a family member or look after children during the school holidays.

In an ideal world, a self-employed person would have more set aside as they feasibly have more call to dip into it than a typical employed worker.

However, in reality, saving up a pot equal to that many months’ salary is hard.

If you feel there’s a more realistic target amount for you, then aim for that. Something is always better than nothing and even a pot of £1,000 can provide a cushion that will prevent you from relying on debt.

Whatever the size of your pot, it’s important to try to keep this topped up, so if you do need to dip into it, try to get it back to where it was when you start earning again.

B) Cash flow management and budgeting for the self-employed, especially when invoices go unpaid

Scour Twitter and it won’t be long before you find evidence of a freelancer who has been wasting precious time chasing unpaid invoices.

This is unfortunate but relatively common.

Even if you don’t have to chase invoices, you might be surprised at the length of payment terms. Unfortunately, large companies can be the worst for not paying their freelancers in a timely way – some have payment terms of up to 90 days.

Even if you ask for early payment, there is no guarantee that this request will be honoured.

If a payment is received after the date you state in the invoice, as long as that time frame is reasonable, you can start to charge interest and apply late payment fees to outstanding invoices.

There are websites that automatically generate and chase invoices for you and these can be worth using if you don’t want to waste your valuable time on this thankless admin task.

C) What does self-employment mean for your chances of getting a mortgage?

Before the coronavirus pandemic, lenders were starting to ease up slightly on the self-employed. Sadly, the pandemic has exposed the financial vulnerability of many self-employed people. As a result, lenders are once more looking rather dimly on those who work for themselves and are either refusing to lend to them, tightening the criteria, asking for larger deposits or increasing the interest rate.

Self-employed people who have several years of accounts and who can prove relatively stable cash flow will be in a better position than those who cannot. A good mortgage broker will help you to avoid rejection, as they know each lender’s attitude and approach and will know which are the best ones to approach for your circumstances.

D) What are the issues for self-employed people with a young family or who are thinking of starting a family?

The big issue for self-employed people wanting to start a family is that they do not benefit from enhanced maternity or paternity pay from an employer. Instead, you will get a maternity allowance from the Government, which is usually a lot less. This means that self-employed parents-to-be might have to do even more saving than employed people ahead of starting a family.

What are the hardest things about being self-employed?

Here are a few of the biggest difficulties:

- Not being paid when having to take time out for illness or holiday

- Chasing payments

- Trying to get a mortgage

Here are a few of the biggest advantages:

- Diversity of work

- Being your own boss

- Freedom to pursue higher paid work

Conclusion

What lies ahead for the self-employed?

Millions of people miss out on pensions, insurance and mortgages – as well as other employee benefits such as holiday and sick pay - through going self-employed.

The extent of this financial sacrifice is likely to have worsened as a result of the coronavirus.

The huge growth in the number of self-employed people over the past couple of decades has brought their financial needs into sharper focus for policymakers.

How can society ensure that, in making this a legitimate choice of work, millions of workers do not suffer poverty in retirement, a lack of protection for their family should the worst happen, or seriously hampered chances of home ownership?

Some options might include:

- auto-enrolment for self-employed people

- more competition and innovation among insurers and lenders

- better access to financial advice for the self-employed

In the meantime, as a prospective self-employed person, your best option is to ensure that you have these financial safety nets set up for yourself, and that you are as clued up as you can be on the product choices open to you.

Checklist before going self-employed:

- Set up a private pension and decide how much income you need to set aside each month, working back from how much income you want in retirement.

- Set up your own life insurance if you previously had this from an employer. This is especially important if you have dependants.

- Set up an income protection policy that will pay out if you can’t work through illness or injury.

- Take a few months to save up a cash buffer. This can be especially useful and should be larger for self-employed people than for employees in order to ride out lean periods when payments are not coming in. Keep this topped up by replenishing your pot in the good times. The usual rule of thumb for everyone is instant access savings worth three to six months of salary. If you are self-employed, it’s a good idea to try and keep towards the upper end.

- Work out how many days holiday you are likely to want to take, as well as how many sick days you realistically might take. Then, using your typical day rate, subtract this number of days (plus a couple of life admin days) from the amount you expect to earn for the year.

- Work out how much you need to charge – is this realistic for your skills, experience, industry and work expectations?

For further information, visit:

IPSE – The Association of Independent Professionals and the Self-Employed - https://www.ipse.co.uk/

The Federation of Small Businesses - https://www.fsb.org.uk/

About Royal London

Royal London is the largest mutual life, pensions and investment company in the UK, with assets under management of £147 billion, 8.7 million policies in force and 4,232 employees. Figures quoted are as at 31 December 2022.

Learn more at royallondon.com

For further information please contact

Lena Nunkoo, PR Manager

- Email: lena.nunkoo@royallondon.com

- Tel: 02032 725 816

- Mob: 07919 171 919