Making contributions

Your contributions are taken from your salary before tax, so you don't pay any tax on your contributions. These tax savings mean that it costs you less to save for your future.

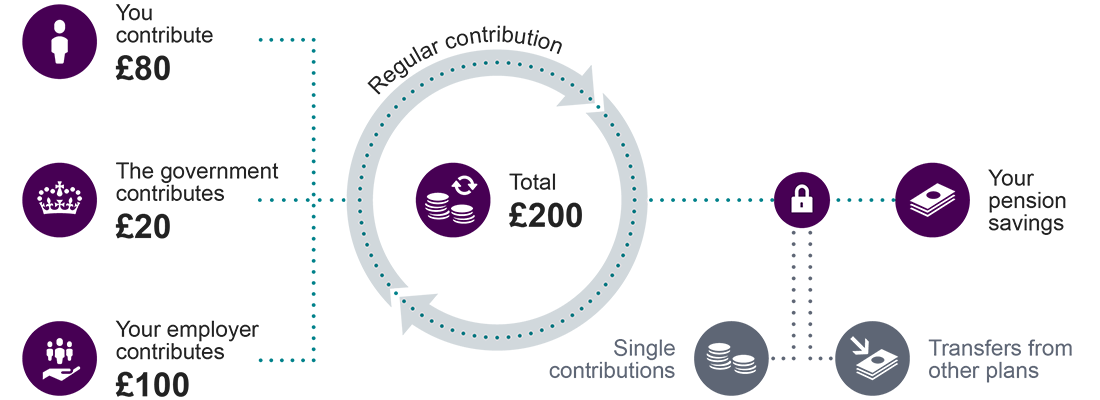

Let’s look at an example for someone who pays basic rate tax with matched contributions from their employer.

- You decide to contribute £100 each month.

- This £100 is taken from your pay before any tax is deducted. This means your tax bill will be lower by £20 (as a 20% tax payer). So your £100 pension contribution will only cost you £80.

- Your employer agrees to match your contribution, so your £80 quickly becomes £200.

Single contributions

You can make single contributions and/or regular additional voluntary contributions into your account, as long as the trustees agree. So if you find yourself with spare cash, you could add it to your account.

Transfer payments

You can transfer pension savings from other pension plans. This could make it easier for you to keep track of them.

Transfer payments from one pension plan to another don’t receive tax relief. Transferring may not be in your best interests as you could lose valuable benefits which can’t be replaced. You should speak to a financial adviser before you make a decision.

Investing your pension savings

Your pension savings are locked away until you reach age 551 and invested to help them grow.

And the longer your money’s invested, the more time it has to grow. So the earlier you start saving, the better off you could be.

Of course, investment returns are never guaranteed. So while your savings could grow, their value can also go down. This means you could get back less than what you put into your plan.

Your retirement options

If the trustees agree, you can access your pension savings any time after age 551 – even if you’re still working. And you’ll normally have three main ways to enjoy the money you’ve saved – buy a secure income, dip in when it suits you or take it all as cash. You can also normally take up to a quarter of your pension savings completely tax free.

Find out more about your retirement options.

1This will increase to age 57 from 6 April 2028.