Making contributions to your personal pension

Managing your finances isn't always easy. So we've worked hard to make saving into your personal pension plan as easy and flexible as possible.

Make regular monthly or yearly contributions

These can be a fixed amount or set to increase each year in line with your salary or earnings, the Retail Prices Index (RPI), or set at a level between one and ten percent.

Even if you're saving into your employer's workplace pension, you can still make contributions into your personal pension. This could be one way of topping up your pension savings.

Your regular contributions are made by Direct Debit.

Top up your pension savings

You can make single contributions into your plan at any time. So if you find yourself with spare cash, you could add it to your plan.

You could have all your pension savings in one place

You can transfer pension savings from other pension plans. This could make it easier for you to keep track of them.

If you decide to transfer your pension savings, your existing provider will make the payment directly to us and we'll do the rest. However, transferring may not be in your best interests as you could lose valuable benefits which can't be replaced. You should speak to your financial adviser before you make a decision.

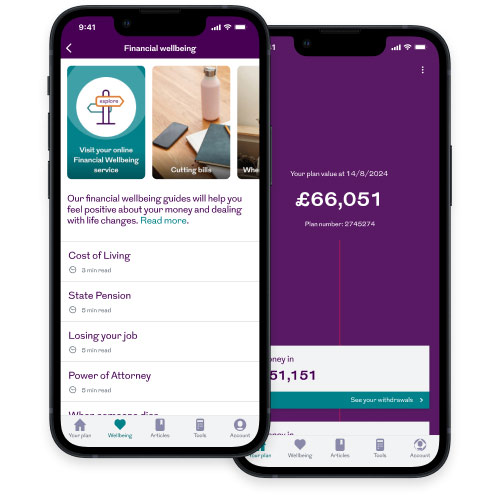

Your plan online

Access your pension plan with our secure online service. It’s really simple to use and you’ll be up and running in no time.

With an intuitive design and simple functionality, you can access a full summary of your plan, including fund performance, your investment information and charges you’ve paid. You'll also be able to update your contact details and nominated beneficiaries and make changes to your investment options.

You can also download our mobile app to keep an eye on your plan, access our articles, podcasts and guides to help you with important topics like budgeting, reducing bills and handling debt.