Saving or investing - Which is best for long-term savings?

Although interest rates have fallen from their highs of 2024, they remain fairly high and they're currently outperforming inflation.

So it's not surprising that people are still questioning whether investing is worth the risk, given they can get decent, what seem like risk-free returns by putting their money in a savings account or cash ISA.

But while having some money in cash savings is a good idea for short-term needs and emergencies, it may not necessarily be the best choice for money you’ll need longer term, for example for your retirement.

The economic background

After 13 years of UK interest rates sitting below 1%, there was a rapid succession of rate rises between the end of 2021 and August 2023, when they reached 5.25%. Rates didn't start falling until August 2024, but they're still fairly high at 4.75% (as at January 2025).

The main reason for the rises was high inflation. The Bank of England is responsible for controlling inflation and keeping it below its target level of 2%. And the main way it does this is by increasing interest rates, the idea being that this will dampen demand and stop people spending so much. Inflation peaked at 11.1% in October 2022. It has now fallen back to 2.6% (as at November 2024), although this remains above the Bank of England's target.

The impact of inflation on cash savings

Saving money rather than investing it can seem like a more attractive option as you get a guaranteed return and your money is generally secure in a bank or building society. Investing always includes some degree of risk, even if you choose lower-risk investments. The value of all investments can go down as well as up, and you could get back less than you paid in.

But what you need to factor in, which a lot of people don’t, is the impact of inflation on cash savings. If the rate of inflation is higher than the interest rate you’re getting then you’re essentially losing money in real terms. So it isn’t a completely risk-free option.

Here’s an example:

- In January, you put £1,000 into a savings account, with an interest rate of 5% a year.

- At the end of the year, your £1,000 has grown to £1,050.

- But as inflation has been running at 8% throughout that year, your money has actually lost 3% of its value in real terms. This means that the £1,050 will be able to buy you less now than the £1,000 did at the start of the year.

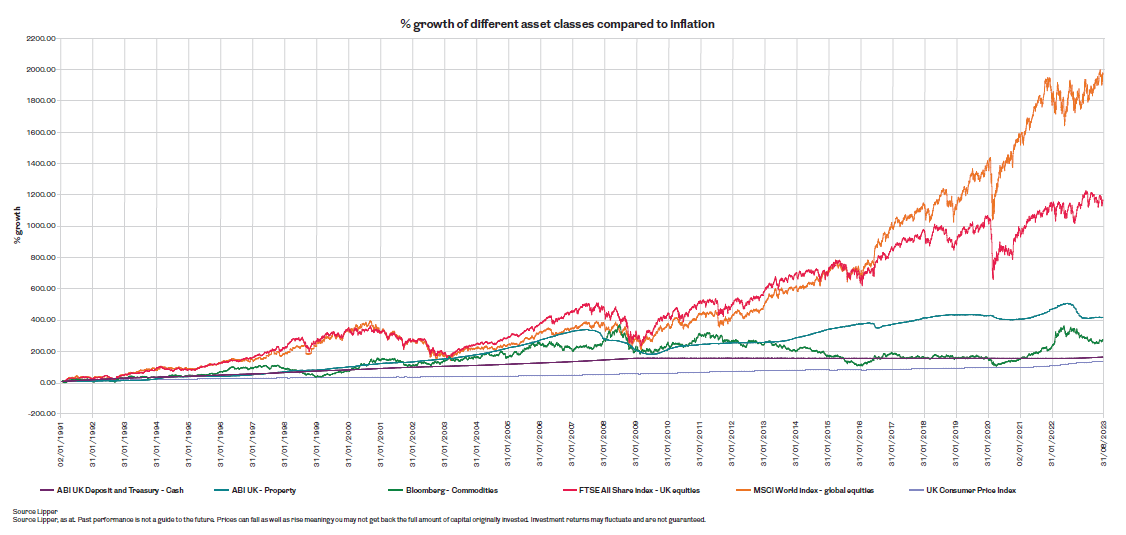

To grow the value of your money in real terms, you need to put it where returns have the potential to be higher than inflation. And although past performance isn’t a guide to future performance, and the value of all investments can go down as well as up and you could get back less than you paid in, history has shown that investments will generally provide above-inflation returns over the long term.

This chart showing the returns of the main types of investments – stocks and shares (equities), commodities, property, bonds and cash-type investments - against inflation illustrates this.

What this means for you

Cash savings still have a role to play

It’s generally considered a good idea to have some money in cash for shorter-term financial goals such as holidays and home improvements, as well as having a rainy day fund for emergencies. How much depends on your own circumstances but having at least enough to cover bills and other essentials for a few months is sensible.

However, for longer-term financial goals, such as building up your retirement savings, investing can help you make the most of your money.

You can choose how much risk you take with your investments

Although no investments are completely risk free, there are plenty of options that let you choose how much risk you're comfortable taking. These will generally include a mix of different types of investments. Different investments tend to perform differently depending on what's happening in the economy, So, by being invested in a mix of investment types, the impact of one performing badly is likely to be mitigated by the performance of others.

Get advice if you need it

Getting professional financial advice can provide reassurance when you’re making important decisions about saving and investing your money. Financial advisers can help you put together a plan for your short- and longer-term goals, and also help you choose options that will give you the best chance of meeting those goals. If you don’t have one, visit our Where to look for an adviser page.

1 www.bankofengland.co.uk

Original article published on 17 October 2023.