Budget 2023: implications for UK investments

With a gloomy economic outlook from the Office for Budget Responsibility constraining the Chancellor’s ability to cut taxes or boost spending in the budget, RLAM head of multi asset Trevor Greetham made the following comments on the implications for UK investments:

“Trying to stimulate growth while the Bank of England is raising rates to fight inflation would be counterproductive, as Liz Truss and Kwasi Kwarteng discovered last year after their ill-named ‘Mini Budget’. It makes sense, therefore, that Jeremy Hunt’s focus today is mostly on supply side measures to encourage labour market participation and capital investment. Arguably, the export sector is most in need of help, but the room to manoeuvre is limited with both major political parties ruling out extending the Windsor Framework approach and Single Market membership across the whole of the UK. Against this backdrop, a new round of austerity is likely, starting in earnest just after the next general election.

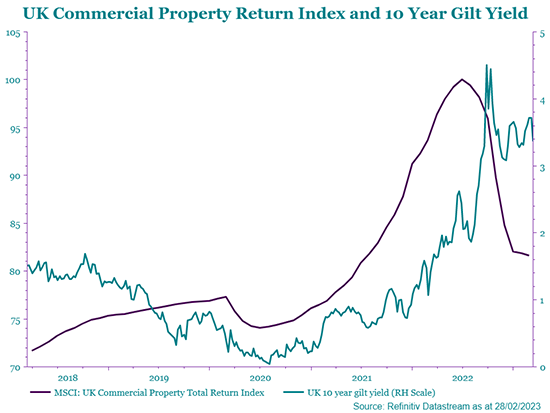

“Economic weakness isn’t great news for investors looking to generate inflation-beating returns, but the FTSE100 could continue to outperform other stock markets if sterling trends lower and commercial property may be the only major asset class already factoring in recession after a near 20% drop from its highs, even including rents. Meanwhile, higher yields and the likelihood of weak growth with falling inflation make gilts more attractive than they’ve been in years.”

For further information please contact

Lena Nunkoo, PR Manager

- Email: lena.nunkoo@royallondon.com

- Tel: 02032 725 816

- Mob: 07919 171 919

About Royal London Asset Management:

Established in 1988, Royal London Asset Management is one of the UK's leading fund management companies, providing investment management solutions to both wholesale and institutional clients such as not-for-profit organisations, local authorities and the insurance sector.

Royal London Asset Management manages £169 billion of assets as at 30 June 2024. It invests in all major asset classes including UK and overseas equities, government bonds, investment grade and high yield corporate bonds, property and cash.

Issued by Royal London Asset Management Limited, registered in England and Wales number 2244297; authorised and regulated by the Financial Conduct Authority. Registered Office: 80 Fenchurch Street, London, EC3M 4BY.

Visit rlam.com to learn more.

For press releases about RLAM please click here.