A new FOI reply to Steve Webb, director of policy at Royal London, suggests that far more low-paid and part-time workers are missing out on tax relief on their pension contributions than previously thought.

In light of this reply, Royal London now estimates that around 1.75m workers could be missing out on around £60m per year in tax relief – a problem which ministers say is not ‘cost-effective’ to tackle.

Last Wednesday (2nd April) Ministers were quizzed on this issue by the DWP Select Committee and they admitted that they “did not know” how many workers were affected. But based on an FOI reply issued on Friday (4th April), Royal London now believes that up to 1.75m workers could be missing out – around half a million more than previously thought.

The issue arises for workers who have to be enrolled into a pension because they earn more than £10,000 per year but who are earning under the income tax threshold – now £12,500 per year. It is thought that around three quarters of these workers are women in low-paid or part-time jobs.

Whether or not these workers benefit from pension tax relief depends on what sort of pension arrangement their employer has chosen. Workers whose employer has chosen a Group Personal Pension arrangement benefit from tax relief because tax relief is given through the ‘relief at source’ method. But workers in most trust-based occupational pension schemes (and in most public service pension schemes) get no tax relief because tax relief is delivered in a different way which excludes those earning under the tax threshold.

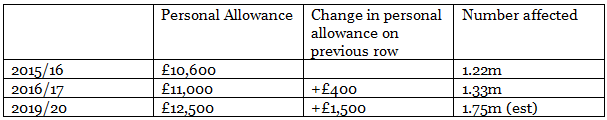

Until now, the only information available was from an FOI supplied to the Low Income Tax reform group, and was based on HMRC data for 2015/16. This found that 1.22m workers were at risk. However, following the release of the 2016/17 ‘survey of personal incomes’ data, Royal London tabled a follow-up FOI which found that the number losing out had risen to 1.33m by 2016/17, an increase of around 110,000. But, as the table shows, this increase happened at a time when the income tax personal allowance had risen by just £400 (from £10,600 to £11,000). Since then, the allowance has risen by another £1,500 (alongside a continued rapid rollout of automatic enrolment, bringing millions more low-paid workers into pension saving).

Source: FOI replies from HMRC and Royal London projection

Ministers told the DWP committee that each worker losing out was missing out on an average of £35 per year. Multiplying this by 1.75m workers suggests a combined loss of around £60m every year until this problem is resolved.

Commenting, Steve Webb, Director of Policy at Royal London said:

“It is a scandal that so many low-paid and part-time workers are missing out on tax relief on their pension contributions. This is the group that most needs a boost to their pension savings. These new figures suggest that the scale of the problem is much bigger than previously thought. It is simply not good enough for ministers to say that it is not cost-effective to deal with this problem”.

Assuming that each extra £400 on the personal allowance (alongside the rollout of automatic enrolment) brings an extra 110,000 people into the net, the further increase of £1,500 might be expected to add another 412,500 by 2019/20. This would bring the total number affected to just under 1.75m – half a million more than previously thought.

Notes to editors:

1. The ‘relief at source’ method provides tax relief to low-paid workers even if they are under the tax threshold. It is used by Group Personal Pension schemes and a small number of MasterTrusts, including NEST. The ‘net pay arrangement’ approach only delivers tax relief to those who are earning over the tax threshold and is used by most trust-based occupational pension schemes and public sector schemes.

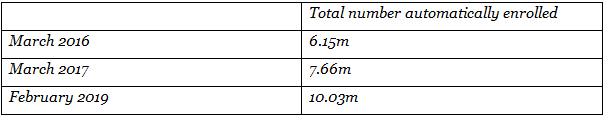

2. Statistics published by the Pensions Regulator show the total number of workers who have been automatically enrolled by the end of each month. The table shows the number who had been enrolled by the end of 15/16, 16/17 and by the latest month for which figures are available:

These figures show that as well as a big increase in the income tax personal allowance between 2016/17 and 2019/20, around another 2.37m workers (many of them lower paid) were enrolled into pensions since the year to which the FOI reply refers, with thousands more set to be enrolled throughout 2019/20. The combined effect of these two factors is to sharply increase the number of workers at risk of missing out on pension tax relief.

For further information please contact:

Royal London Press Office

- Email: pressoffice@royallondon.com

About Royal London

Royal London is the largest mutual life, pensions and investment company in the UK, with funds under management of £130 billion, 8.8 million policies in force and 4,046 employees. Figures quoted are as at June 2019.

At Royal London, we’re proud to champion the value of impartial advice. We believe it plays a crucial role in connecting people with the products that are right for them – and is key to delivering better outcomes and experiences for our customers. At the same time, it helps to build trust in our products and services.

Royal London works alongside advisers not in competition with them. That’s why we’ve made some key commitments to the intermediary market. You’ll find more detail on our commitment to advisers at http://adviser.royallondon.com/campaigns/our-commitments/