If you’re a basic rate taxpayer, you’ll automatically get 20% tax relief on money you pay into your pension. So for every £80 you put in; the government will top it up to £100.

Let’s look at an example for Sam. Sam pays basic rate tax and earns £2,000 a month. They pay 5% of their salary into their pension and their employer also pays in 3%.

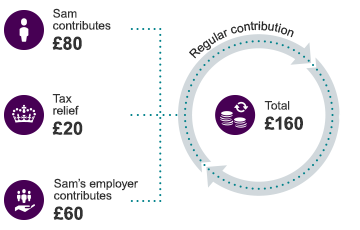

- Sam pays £80 into their pension each month

- They get £20 on top of this in tax relief from the government

- This means Sam only needs to pay in £80 to get a £100 contribution into their pension

- Because Sam’s employer also pays into their pension, that original £80 contribution quickly becomes £160.

Paying more in

With tax relief, the more you pay into your pension, the more help you’ll get from the government to save for your future. Let’s take a look at some more examples for someone paying basic rate tax:

| You pay | Tax relief added as a boost to your contribution | Total pension contribution |

|---|---|---|

| £100 | £25 | £125 |

| £160 | £40 | £200 |

| £240 | £60 | £300 |

The above figures are an example to show you how tax relief works, based on UK income tax rates and bands, excluding Scotland. You should speak to your employer to find out more about your own pension contributions, and how much they’re paying in.

If you pay a higher or additional rate of income tax you could benefit from additional tax relief which you can claim from HM Revenue & Customs (HMRC). Remember, tax relief depends on your individual circumstances and where you live in the UK and may change in the future.