If you are saving into a workplace pension scheme, the contributions made by you and your employer are shown on your payslip. But understanding what these numbers mean can sometimes feel tricky.

Where to find your pension contributions on your payslip

Your payslip has several important sections:

Personal and tax information

- Personal details like your name, address, National Insurance number and payroll number

- Pay date, tax period and your HMRC tax code. Make sure to double-check your tax code to avoid paying too much tax. More information about tax codes can be found in our Tax codes explained guide.

Pay information

- This will include pay, overtime, bonuses and commission before any income tax or National Insurance is deducted

- Any maternity or paternity pay and sick pay will also be shown

- If you work variable hours, it might show your hourly rate and the number of hours worked

- Sometimes, pension contributions from your employer will appear in this section

- The amount of pay before all deductions is known as your gross pay.

Deductions

- Tax and National Insurance will be shown here

- This is where you’ll usually see pension contributions being deducted

- Other deductions might include workplace benefits, student loan repayments or charitable donations made through payroll

- The amount of pay after all deductions is called net pay.

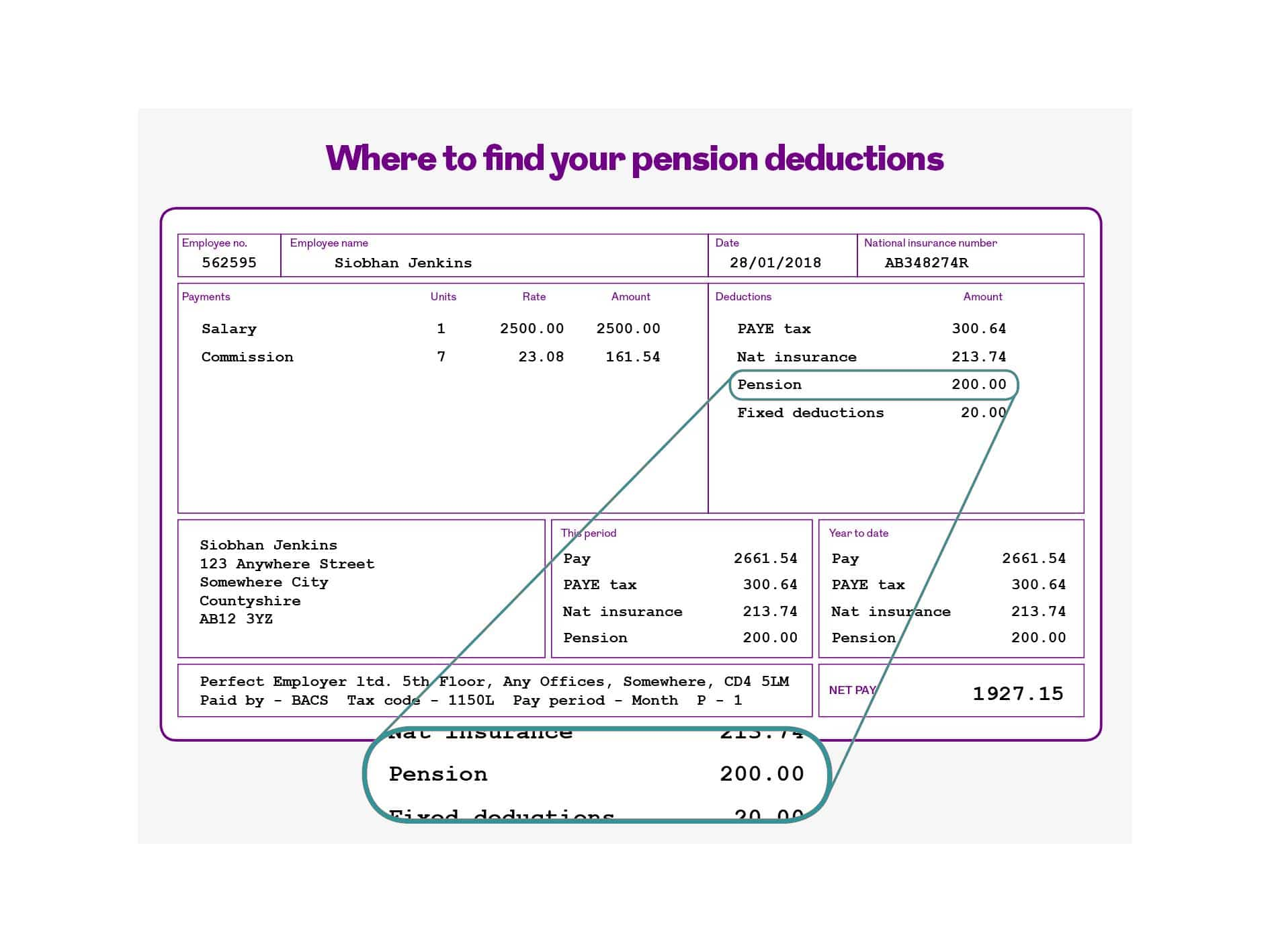

Example of a payslip

In the example below you can see the payslip for a fictional employee, Siobhan Jenkins. Under “payments” she has salary of £2,500 and commission payments of £161.54.

Under deductions you can see PAYE tax (income tax) of £300.64, National Insurance of £213.74, a pension deduction of £200.00 and a fixed deduction of £20.00. The pensions deduction is circled.

There is other information about her employer, tax code, pay period as well as a box highlighting her net pay - the amount she’ll receive into her bank account.

It's normal for both you and your employer to pay money into your workplace pension when you get your salary – also known as a pension ‘contribution.’

Your employer’s contribution may not be shown on your payslip, but it can help to boost your pension savings.

A square payslip which is broken up into a number of boxes.

The first block "payments" shows a fictional employee. Siobhan Jenkins's Salary of £2500 and commission £161.54

The 2nd block to the right of the "payments block" shows Siobhan's salary after deductions. This shows here PAYE tax deduction of £300.64, her National insurance deduction of £213.74, a Pension deduction of £200.00 and a fixed deduction of £20.00 The pensions deduction is circled.

The final blocks shows supporting information such as her address, employers details and Net pay of £1927.15

Codes you might see on your payslip

Sometimes acronyms or abbreviations are used on your payslip. Some of the most common codes used in relation to your pension and what they mean are below;

| Code | Meaning |

| EE pension | Employee pension contribution |

| ER/ERS pension | Employer pension contribution |

| NI(C) | National Insurance Contributions |

| PAYE tax | Pay As You Earn income tax |

| AE | Automatic Enrolment |

| Sal Sac/SE | Salary sacrifice/Salary exchange |

If you don’t understand the pension numbers or abbreviations on your payslip then ask your Human Resources or payroll department.

Understanding different types of workplace pension contributions

How pension contributions appear on your payslip depends on whether you have a defined benefit or defined contribution pension.

A defined contribution pension is a type of pension where you and your employer save for your future. The money is invested to help it grow, but remember, investment returns are never guaranteed. So, while your investment could grow, its value can also go down. This means you could get back less than you put into your plan. It’s up to you to make sure that you have enough money to last throughout your retirement.

A defined benefit scheme is a type of pension where your employer promises to pay you a set amount of income from when you retire until you, or your partner if you have one, die. There are two forms;

- A final salary scheme provides an income when you retire based on how long you've been a member of the scheme and how much you're earning when you stop working.

- A career average scheme bases the promised income on how long you've been a member and the average of salary earned over your period of membership.

How do Defined Contribution pension deductions work?

If you're a member of a DC workplace pension scheme, your contribution can be deducted from your payslip and paid into your pension in two ways.

If you’re a member of a group personal pension

When you pay into your pension from your pay packet, you’ll get a boost from the government in the form of tax relief. Any contributions paid into your plan will benefit from an additional 20% in the form of tax relief.

This means that for you to pay £100 into your pension every month, then you only need to contribute £80, as the government will add the other £20. The contribution from your employer will be added onto that.

If you pay income tax over the basic rate, then you'll need to claim any additional tax relief, over the 20% you receive automatically, back from HMRC. This means that the extra 20% or 25% doesn't automatically go into your pension. You can either claim this back in your online tax return, if you fill one out, or by letter. More information on tax relief can be found in our Pension tax relief guide.

If you’re a member of a DC occupational pension scheme

The pension contribution on your payslip is usually deducted before you pay any tax, as with a Defined Benefit pension scheme (see below).

In this case, you get all the tax relief straight away, so there's no need to make any further claim.

How does salary sacrifice work?

Many employers also offer something called 'salary sacrifice' (also known as 'salary exchange'), which is an agreement between you and your employer where you exchange part of your gross salary for a workplace pension contribution.

The advantage of this is that you pay less income tax, and you and your employer pay less National Insurance. This is because your salary is reduced before tax and National Insurance are taken.

If you’ve agreed to make salary exchange contributions, you will normally see on your payslip that a reduction in gross pay has taken place as part of a 'salary exchange' arrangement. However, even if no pension deduction is shown on your payslip, you're still a member of the pension scheme.

How do Defined Benefit pension deductions work?

Your payslip will show a deduction for your pension contribution. This is the amount required to be a member of the Defined Benefit pension scheme.

In many schemes, this deduction is a simple percentage of your salary. In the public sector, this percentage is generally more for higher earners.

If you're a member of a DB scheme, your pension contribution is taken from your gross wage before you pay any tax. This reduces your taxable income and therefore reduces the amount of tax you pay.

For example, if you're expected to contribute £100 per month to be a member of your employer’s DB pension scheme, your payslip will show a £100 contribution. However, when your tax bill is calculated, your income for tax purposes will be £100 lower than someone who isn't in the pension scheme.

If you're a basic rate (20%) taxpayer, this means that you will pay £20 less tax. If you pay tax at the higher (40%) rate, then you’ll pay £40 less.

In this case, you get all the tax relief straight away, so there's no need to make any further claim.

How do I find out what type of workplace pension I have?

If you don't understand whether or not you need to claim back any tax from HMRC, it's worth asking your Human Resources department, payroll department, or pension provider.