Your payslip often shows a deduction for payments into your employer’s workplace pension scheme. How is this amount worked out and what does it mean for your tax bill?

Understanding different types of workplace pension

Sometimes the information on your payslip can be tricky to understand. First, it's worth remembering that there are two main types of workplace pension:

- Defined Contribution (DC) pensions, where your contributions are invested until you start accessing your pension savings

- Defined Benefit (DB) or 'final salary' pensions, where the amount you get at retirement depends on how long you were in the pension scheme, and the salary you’ve earned at the time you either leave that employer or retire.

In both cases, it's normal for both you and your employer to pay money into your workplace pension when you get your salary – also known as a ‘contribution.’

Your employer’s contribution may not be shown on your payslip, but it can help to boost your pension savings.

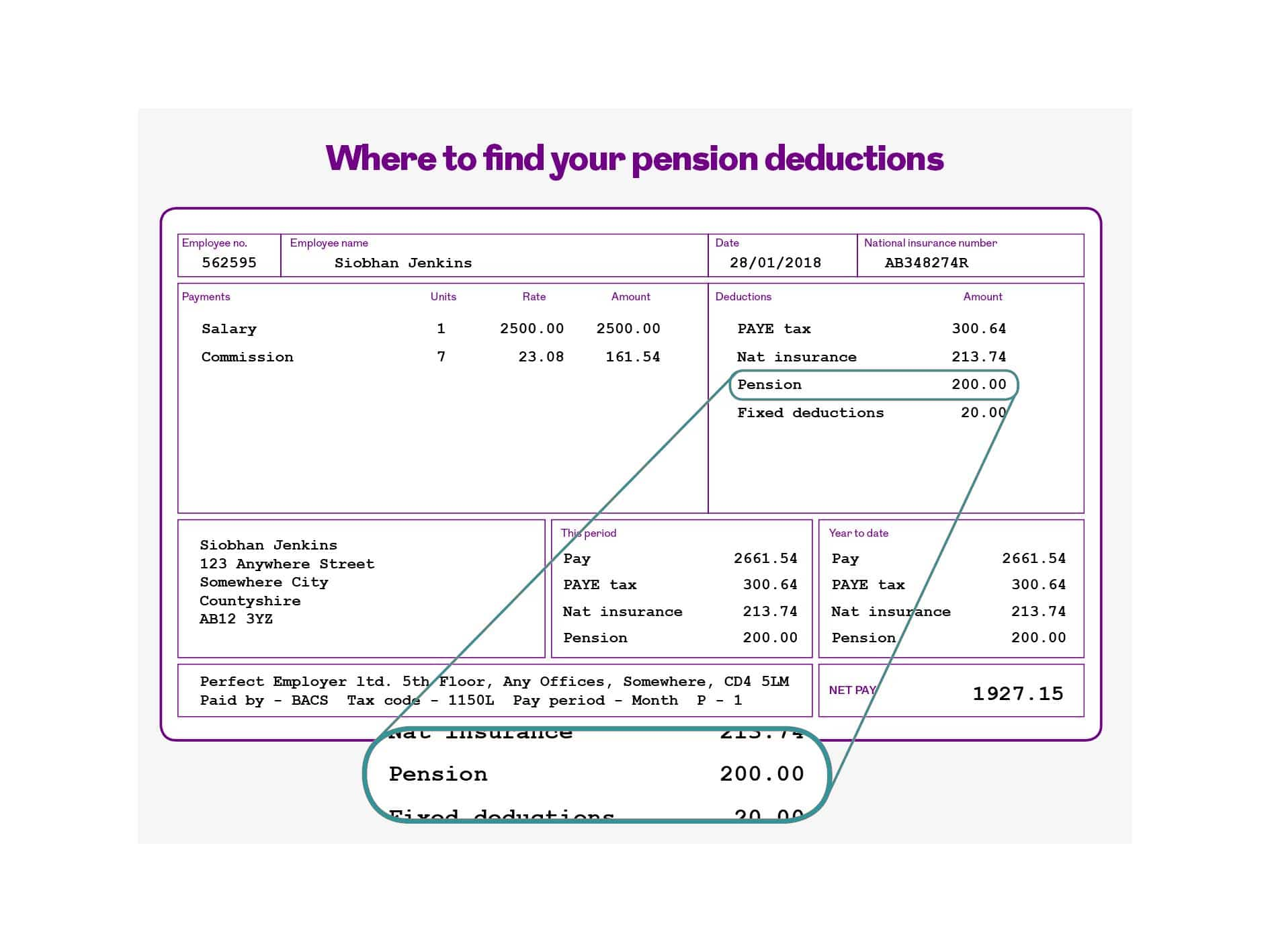

A square payslip which is broken up into a number of boxes.

The first block "payments" shows a fictional employee. Siobhan Jenkins's Salary of £2500 and commission £161.54

The 2nd block to the right of the "payments block" shows Siobhan's salary after deductions. This shows here PAYE tax deduction of £300.64, her National insurance deduction of £213.74, a Pension deduction of £200.00 and a fixed deduction of £20.00 The pensions deduction is circled.

The final blocks shows supporting information such as her address, employers details and Net pay of £1927.15

How do Defined Contribution pension deductions work?

If you're a member of a DC workplace pension scheme, your contribution can be deducted from your payslip and paid into your pension in two ways.

If you’re a member of a group personal pension

Your pension contribution will come out of your take-home pay and be topped up thanks to tax relief. This means that if you contribute £100 to your pension every month, and you’re a basic rate taxpayer, you only need to contribute £80, as the taxman will contribute the other £20.

If you're on an intermediate rate (which applies to Scottish taxpayers only), higher rate, or you’re an additional rate taxpayer, you could be entitled to claim more tax relief through a self-assessment tax return, or by contacting HMRC.

If you’re a member of a DC occupational pension scheme

The pension contribution on your payslip is usually deducted before you pay any tax, as with a Defined Benefit pension scheme.

In this case, you get all the tax relief straight away, so there's no need to make any further claim. Keep in mind that you won't receive tax relief if you're a lower paid worker who is under the tax threshold.

How do Defined Benefit pension deductions work?

Your payslip will show a deduction for your employer’s contribution. This is the amount required to be a member of the Defined Benefit pension scheme.

In many schemes, this deduction is a simple percentage of your salary. In the public sector, this percentage is generally more for higher earners.

You will usually benefit from a tax break when you save into your pension. If you're a member of a DB scheme, your pension contribution is taken from your gross wage before you pay any tax. This reduces your taxable income, and therefore reduces the amount of tax you pay.

For example, if you're expected to contribute £100 per month to be a member of your employer’s DB pension scheme, your payslip will show a £100 contribution. However, when your tax bill is calculated, your income for tax purposes will be £100 lower than someone who isn't in the pension scheme.

If you're a standard rate (20%) taxpayer, this means that you will pay £20 less tax. If you pay tax at the higher (40%) rate, then your tax bill will be £40 less.

How does salary sacrifice work?

Many employers also offer something called 'salary sacrifice' (also known as 'salary exchange'), which is an agreement between you and your employer where you exchange part of your gross salary for a workplace pension contribution.

The advantage of this is that you pay less income tax, and you and your employer pay less National Insurance Contributions (NIC). This is because your salary is reduced before tax and NIC are taken.

If you’ve agreed to make salary exchange contributions, you will normally see on your payslip that a reduction in gross pay has taken place as part of a 'salary exchange' arrangement. However, it’s possible that even though no pension deduction is shown on your payslip, you're still a member of the pension scheme.

If you don't understand the pension figure on your payslip, it's worth asking your Human Resources department, payroll department, or pension provider to make sure everything's in order.