What are stock markets and how do they work?

Curious about stock markets? We explain the basics in simple terms, so you can understand how they work and what to expect if you're thinking about investing.

What is a stock market?

A stock market is a place where people can buy and sell shares in companies. When you own a share, you own a part of that company. The prices of shares can go up and down for various reasons, including how well companies are doing and how much people want to buy or sell their shares.

Stock markets help companies raise money to grow their business while giving people a chance to invest and potentially make a profit.

What is a stock exchange?

While a stock market is the general term for all the buying and selling of shares in companies, a stock exchange is a specific place (or online platform) where these shares are actually bought and sold - think of it as the marketplace itself. For example, the London Stock Exchange is one of the places where shares are traded, and together with other exchanges, it makes up the wider stock market.

Why do people invest in the stock market?

- To make money - if the value of shares goes up, investors can sell them for a profit.

- To get payments from companies - some companies pay out a part of their profits to shareholders, known as dividends.

- To support companies - investing in shares helps companies get the money they need to grow.

What is the FTSE 100?

The FTSE 100 (pronounced "footsee one hundred") is what’s called a stock market index. It’s a list of the 100 biggest companies listed on the London Stock Exchange. These are well-known companies, such as banks, supermarkets and energy companies, that are based in the UK or have a strong presence here.

You might have also heard of some other well-known stock market indices like the S&P 500 in the US, which follows the 500 biggest American companies, and the Nikkei 225 in Japan, which tracks 225 leading Japanese companies.

Why is the FTSE 100 important?

The FTSE 100 shows how the biggest UK companies are doing. If it goes up, those companies are generally doing well; if it goes down, their value has dropped.

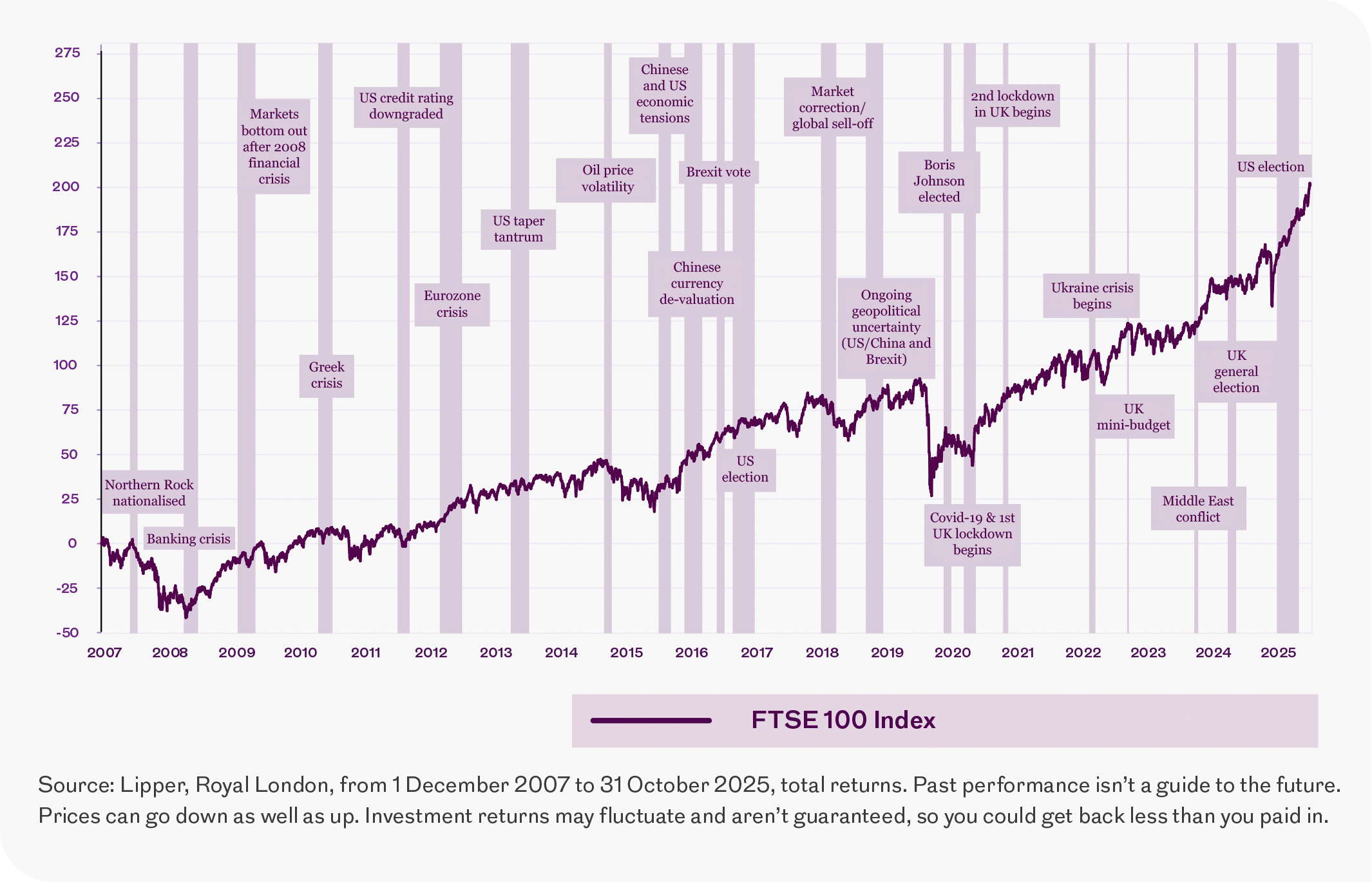

Looking at the last 20 years, the FTSE 100 has had its ups and downs - often because of major global events like the banking crisis in 2008 or the Coronavirus pandemic. This means your investments can rise and fall too, and there’s always a chance you could get back less than you put in. That’s just part of investing. The key is to stay calm and focus on your long-term goals.

Overall, even though the FTSE 100 has had some big drops, it has grown a lot over the long term. If you had invested in a UK fund with exposure to the FTSE 100 in 2007 and kept your investment through all the ups and downs, you would have faced tough times but ultimately ended up with a positive return.

Just a quick reminder: Investments can go down as well as up, so there’s always a chance you might get back less than you originally put in. While it’s great to hope for growth, nothing is guaranteed - and how things have performed in the past doesn’t always tell us what will happen in the future.

How to invest in the stock market

It's easier than you might think to invest in the stock market. If you're paying into a pension, the chances are that you're already investing in the stock market. You can also invest through a stocks and shares ISA.

Some risks to consider

- No guaranteed returns: There’s no promise you’ll make a profit, even if the stock market has done well in the past.

- Market ups and downs: Big events, like financial crises or global news, can cause sudden changes in share prices which can impact the value of your investments.

- Long-term commitment: Investing is usually best for the long term (at least five years), so you might need to leave your money invested for several years.