UK homeowners walking financial high wire without a safety net

- Homeowners are three times more likely to have life insurance than income protection

- Income protection is overlooked in favour of life insurance, only 2 in 10 homeowners have income protection in place

According to findings from Royal London’s latest report1, 'Tackling the gender pension and wealth gap', many people in the UK are underprepared to pay their monthly housing costs if they’re unable to work due to illness or disability.

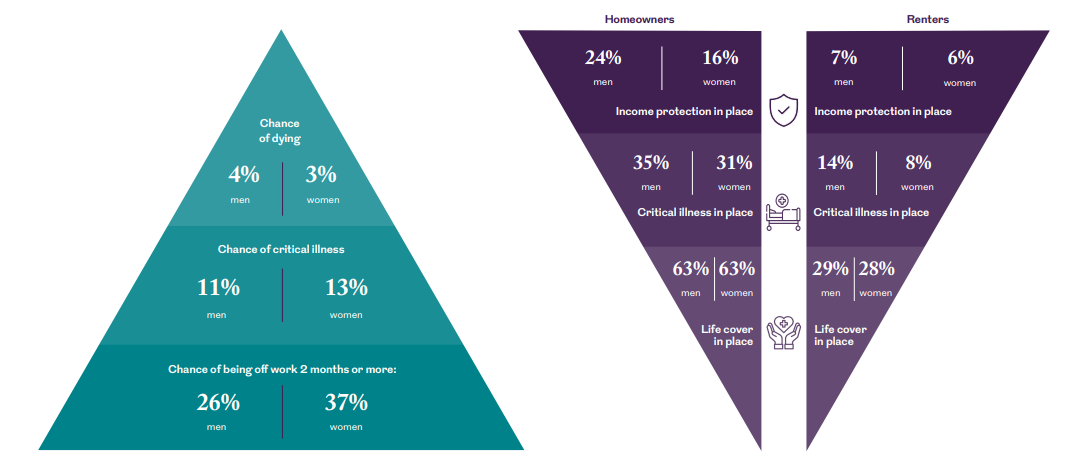

When it comes to providing a financial safety net in the event of sickness, accident or ill health, there are a staggering number who are underprepared. Royal London’s research shows 8 in 10 homeowners paying a monthly mortgage do not have income protection in place, and two thirds have no protection should they be diagnosed with a critical illness, risking their financial stability if they are unable to work because of a longer-term illness.

While the numbers who have safeguarded the family home if they die sooner than expected are more encouraging – two thirds (63%) have life cover – it is worrying that so many do not have a policy to replace their income if they are unable to work through illness or disability. Statistically men are around six times, and women 12 times more likely to be ill and unable to work than they are to die2, making income protection insurance essential. Income protection is a policy that gives peace of mind knowing there is a replacement income with a monthly pay out to pay the bills.

Of course, homeowners aren’t the only ones with financial commitments who need to keep a roof over their head. Tenants also need to pay their rent and can be just as exposed without insurance in place, yet the statistics make for even more concerning reading. Less than a third (29%) of renters have life cover, and only 6% have income protection.

Life expectancy and risk of illness before retirement

Based on 30 year old with a planned retirement age of 65

Both aged 30, non-smokers, planned retirement age of 65. Pacific Life Re, June 2021. These figures have been produced based on their interpretation of the Institute and Faculty of Actuaries’ Continuous Mortality Investigation insured lives incidence rates together with their estimated view of future trends. Incidence rates for the entire population may be different to those lives that take out insurance products.) Numbers on the right-hand side are based on the incidence within the consumer research of 3,000 individuals conducted in 2023.

Missing the protection opportunity

Taking out a protection product is often triggered by a life event such as getting married or buying a house. However, as rising property prices lead to home purchases happening later in life, and increasing numbers of people choose to co-habit rather than marry3, conversations about protection insurance are being missed or delayed.

Jennifer Gilchrist, protection expert at Royal London, said:

"With so many people in the UK already struggling to make ends meet, the thought of a family member losing their salary during a cost of living crisis is unimaginable.

"Wanting to protect yourself and your loved ones financially should hard times hit is natural, yet many families are leaving themselves financially exposed. It’s important that awareness is raised about the positive impact of having insurance in place and the difference it can make to improve people’s financial resilience.

"While it’s encouraging that life insurance is in place for many homeowners, statistically it’s far more likely that during someone’s working life they will be off work due to illness or injury, rather than die. It’s vital that people understand the importance of having cover beyond just life insurance.

"Even though lenders no longer insist on taking out life insurance to get a mortgage, buying a home is still a significant trigger for people to buy protection insurance. It’s a simple way to ensure the family home is protected if the main breadwinner dies, but we need to look beyond just the risk of premature death."

Emma Astley, founder of Lancashire-based Cover My Bubble, said:

"The rising cost of living means many families up and down the UK are acutely aware of their outgoings and the need to protect their monthly bills. Protection insurance goes way beyond just life insurance, with the benefit of protecting your mortgage. We know our customers often get the biggest reassurance from putting cover in place for their income and expenses, rather than for their life or mortgage cover.

"Where some people need their entire mortgage amount covering, others want the reassurance that their monthly rent and essential bills are protected. As many employers don’t provide sufficient sick pay to cover for prolonged time off work, providing critical illness and income protection, gives individuals and families peace of mind that bills can still be paid when illness and injury strike.

"We also need to create more awareness for families who rent to consider their requirements and put in place the right package of cover. It’s generally accepted that for complete financial protection a little bit of each cover is ideal.

"Accessing advice means individuals’ needs are assessed, allowing families to put in place a package that provides reassurance and gives them protection for many potential life events."

Notes to editor

- Royal London partnered with independent research agency Cicero/amo to undertake a nationally representative survey of 3,000 adults in the UK. Fieldwork was conducted in September 2023.

- Pacific Life Re, June 2021, based on 30 year old non-smokers, retirement age of 65.

- ONS data reveals 'opposite-sex cohabiting couple' was the fastest growing family type over the last 10 years.

For further information please contact:

Neil Cameron, PR Manager

- Email: neil.cameron@royallondon.com

- Mob: 07919 171969

About Royal London

Royal London is the largest mutual life, pensions and investment company in the UK, and in the top 25 mutuals globally, with assets under management of £162 billion, 8.6 million policies in force and over 4,200 employees. Figures quoted are as at 31 December 2023. Learn more at royallondon.com.