Self-employed must earn nearly £10,000 a year more than full-time staff to make up for lost employee benefits

· The average annual replacement cost of typical employee benefits is £9,586

· If maternity leave is included, the cost is £20,836

· Excluding one-off benefits and looking just at holiday pay, sick pay, employer pension contributions, life insurance and health insurance, the extra annual cost is about £7,200

· The self-employed must earn almost £28 per day extra to cover the loss of paid employment benefits

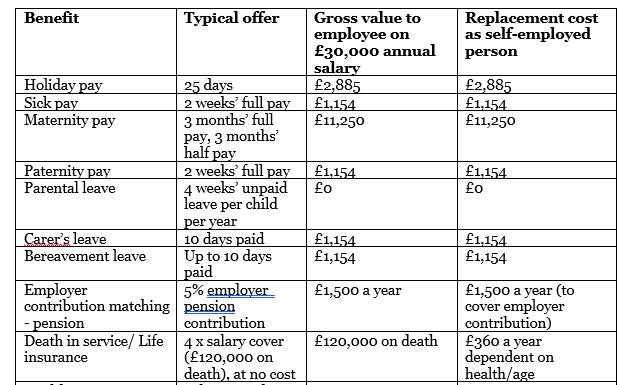

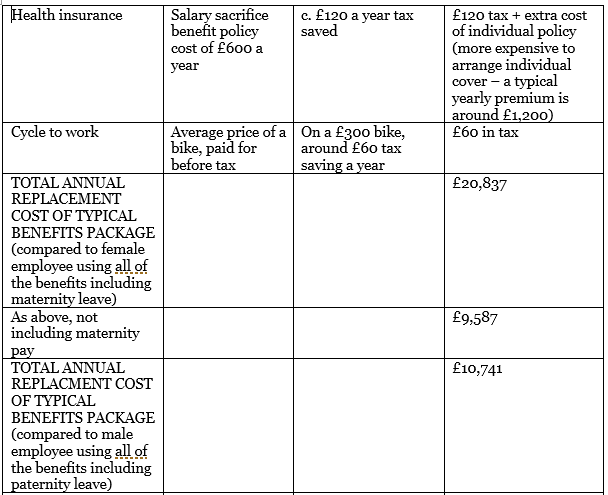

New analysis by Royal London reveals the true cost of going self-employed. According to our data, the self-employed must earn nearly £10,000 a year more than full-time staff to make up for lost employee benefits. If maternity pay is taken into account, that figure rises to more than £20,000. (see table below)

While self-employment can be an attraction option for various reasons, including being your own boss, the loss of key benefits such as holiday pay, sick pay, and employer pension contributions means that anyone thinking of becoming self-employed should plan their finances carefully before taking the leap. The cost of things that many employees take for granted, such as health insurance and maternity/paternity pay, must be shouldered by the self-employed individual.

It is also worth bearing in mind that many self-employed have missed out on financial support from the government during the pandemic.

Royal London has broken the value of employee benefits down, and the cost of replacing them, based on the average UK full-time employee salary of £30,000,¹ to give an idea of the extra amount beyond current earnings that the self-employed would need to earn in order to cover themselves.

The typical value of employee benefits and what it would cost to replace them if you are self-employed:

NB. Typical doesn’t mean the legal statutory minimum, but what large employers typically offer to staff as part of a benefits package.

However, it is unlikely that someone would claim all of these benefits in a single year, with benefits like maternity or paternity only likely to be claimed once or twice. Also, claiming carer’s leave and bereavement leave up to the maximum number of days would be unlucky, although it is anticipated that these entitlements have been more important during the pandemic.

Nevertheless, removing the one-off benefits and looking just at holiday pay, sick pay, employer pension contributions, life insurance policy payments, health insurance policy payments and tax savings, the extra cost of providing all of these things for oneself in a year could be around £7,200.

The employed day rate for someone on £30,000 is £115 a day. If you were to go self-employed at the same level, you would need to earn almost £28 per day extra to cover the loss of all the paid benefits you had before, such as holiday pay and sick pay.

Mona Patel, consumer spokesperson at Royal London, said:

“While the number of self-employed has fallen during the pandemic, there are still more than 4 million self-employed people in the UK. For some, self-employment remains the only alternative to unemployment in an economy where full-time work no longer offers the security it once did.

“Self-employment can offer many benefits, including the flexibility of being your own boss to being in charge of your working hours. But anyone considering going down this route should plan their finances carefully, and make sure they don’t lose out on crucial things like pensions and life insurance.”

Find out more on our guide to going self-employed.

Notes to Editors

1. In 2019, median annual earnings were £30,378; in 2020, the figure was £31,461, according to Statista, a data company.

About Royal London

Royal London is the largest mutual life, pensions and investment company in the UK, with assets under management of £147 billion, 8.7 million policies in force and 4,232 employees. Figures quoted are as at 31 December 2022.

Learn more at royallondon.com

For further information please contact

Lena Nunkoo, PR Manager

- Email: lena.nunkoo@royallondon.com

- Tel: 02032 725 816

- Mob: 07919 171 919