Protecting savings from soaring inflation and living costs

- Energy bills are at an all-time high and inflation rose by 4.2% in the twelve months to October 2021, peaking at levels not seen in over ten years

- New research from Royal London reveals how to protect your money from inflation and extremely low interest rates on savings

- The research shows you could lose as much as a third (34%) of the “real value” of your money by keeping savings in high street savings account over ten years

- Analysis shows nearly a £5,000 difference in purchasing power of your money when kept in a pension pot over 15 years, rather than a high street bank account

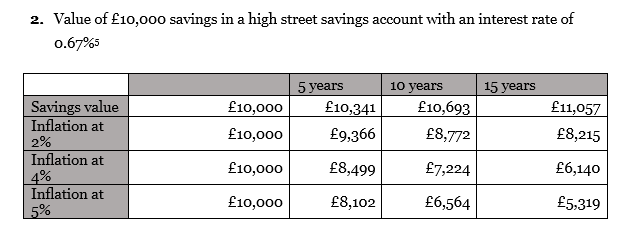

Record inflation rates mean savers risk losing up to a third of the value of their savings if they keep them in a high street bank account for ten years. Interest rates on high street easy access savings account are reaching 0.67%, still 2.43% below the rate of inflation.

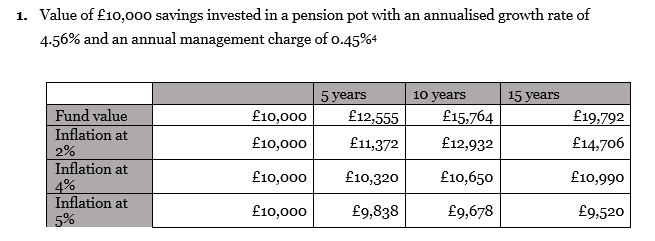

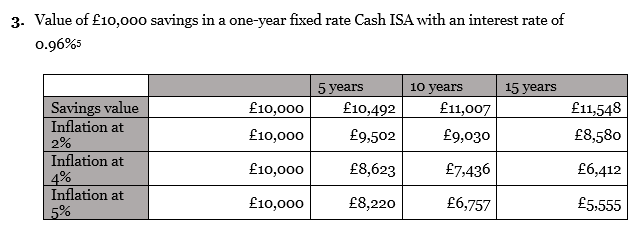

Royal London, the UK’s largest mutual life, pensions and investment company, compared the growth of the average savings amount of £10,0001 spanning over five years, ten years and fifteen years. The analysis compared two savings and one investment vehicle; a pension pot, a high street savings account and a Cash ISA.

The figures show that the purchasing power of savings left in a high street savings account will decrease over time as inflation increases; if inflation rises to 4%, the purchasing power over ten years will fall by more than a quarter (27%), and if inflation reaches 5% over ten years, you would lose over a third (34%) of the “real value” of your money. While the Bank of England is tasked to keep inflation at 2%, a sudden deluge of spending or continued problems with the supply chain could keep the rate well above target.

If inflation reaches average levels of 4% next year and stays at this level over five years2, it will reduce spending power by as much as £1,500, whilst saving in a pension pot over the same period could help grow the money by £320. The money would also lose more than £1,300 in purchasing power if kept in a Cash ISA for five years.

The Office for Budget Responsibility recently predicted that inflation would peak at around 5% next year. Royal London’s figures show that if inflation does rise to this level and stays there, you would lose almost half (47%) of the “real value” of your money after 15 years in a high street savings account3.

If savings were kept in a high street savings account, for ten years against a 5% inflation rate, the purchasing power of the savings would decrease by a third (34%) to £6,564.00, If the savings were instead kept in a Cash ISA paying 0.96% over this period, they would also lose a third (32%) of their purchasing power, reducing to £6,757.00.

See tables below:

Commenting, Sarah Pennells, consumer finance specialist at Royal London, said:

“If you have money in savings, it is important to keep an eye on interest rates and where your money is saved. Rates are lower than ever and you will lose money if inflation is higher than the interest rate offered on your savings account or cash ISA. You can reduce the effects of inflation by making sure your savings are in a ‘best buy’ account, and not one languishing at the bottom of the league tables.

“However, we also know that many people don’t save enough for the kind of retirement lifestyle they’d like. And – while returns aren’t guaranteed – you may be better off putting some of your spare cash into your pension, especially if you will also get a contribution from your employer. It’s important to have an emergency savings fund, so don’t top up your pension if you have no savings to fall back on.

“If you do want to keep your money in cash, be careful to do your research and check the terms and conditions of the account. An increasing number of banks are adding restrictions to the best savings deals, including penalties for making too many withdrawals and short-term bonuses7 that make deals appear more attractive than they really are - unless you remember to switch.”

Notes to Editors

1.Raisin.co.uk found the average UK saving was (£9,633.30.) We have rounded this up to £10,000 for the purposes of research.

2. Predictions from the Office for Budget Responsibility that inflation will reach four percent on average throughout next year, peaking at around five per cent.

3. This assumes that inflation remains at 5%.

4. An investment growth rate of 4.56% - this is the current mid-rate for Royal London’s GP4 investment option which is the most common investment. The average annual management charge (AMC) across Royal London’s Individual pensions is 0.45%, and the average AMC across new Workplace pensions set up with Royal London is approximately 0.45% too. Therefore, this figure can be used to represent the money being invested in either a personal or a workplace pension.

5. Figure taken from Times Money Mentor article with highest interest rate of 0.67% from Shawbrook Bank. This assumes no tax is paid on the interest.

6. Interest rate of 0.96% from Castle Bank with one fixed rate ISA for one year, taken from Money Saving Expert guide to top cash ISA’s.

7. Information taken from article titled “Banks sneaking restrictive T&Cs onto unsuspecting savers” on The Telegraph.co.uk, dated 29th November 2021.

About Royal London

Royal London is the largest mutual life insurance, pensions and investment company in the UK, with assets under management of £153 billion, 8.8 million policies in force and 4,075 employees. Figures quoted are as at 30 June 2021.

For further information please contact

Lena Nunkoo, PR Manager

- Email: lena.nunkoo@royallondon.com

- Tel: 02032 725 816

- Mob: 07919 171 919