ProfitShare in practice

To give you an idea of the difference ProfitShare could make, let's introduce you to Harry.

Harry has just joined his employer's pension plan.

- He's aged 30

- He's decided to contribute £230 each month

- He'll transfer £25,000 from a previous pension into his employer's pension plan

- He wants to retire at age 65

Harry’s projected pension savings

This figure isn't guaranteed and is just an example. Harry could get more or less than this.

We've assumed he'll increase his pension contributions in line with inflation each year and that he'll contribute until he retires at age 65. We've also assumed we'll apply a yearly management charge of 1% to all his pension savings.

We've assumed that inflation will reduce the buying power of Harry's pension savings by 2% each year. We've allowed for this by reducing the growth rate to 2.6%. This should give a more realistic view of what Harry could buy with his plan if his retirement income was payable today.

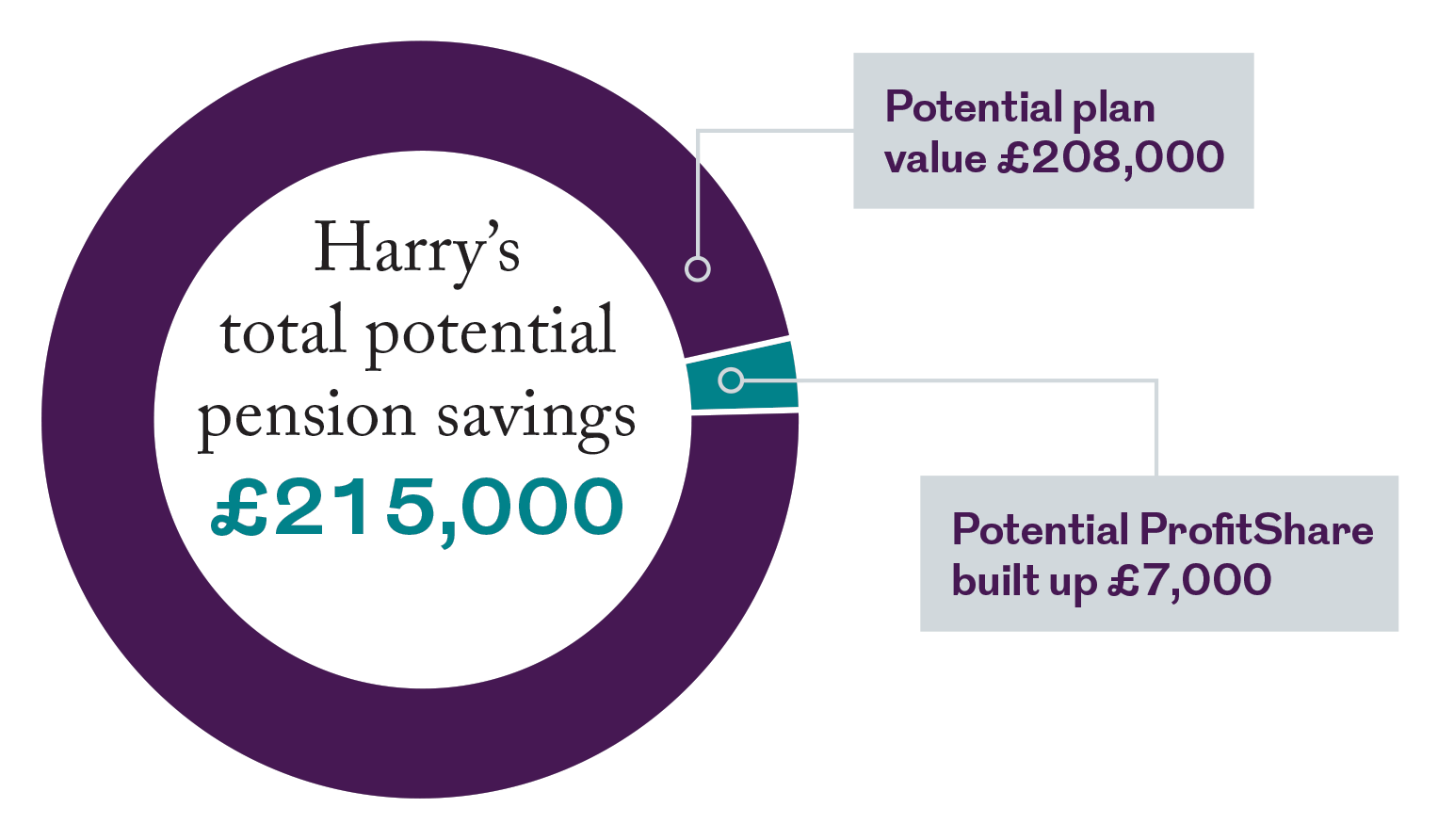

The impact of ProfitShare for Harry

Now let's look at the difference ProfitShare could make to Harry's pension savings, assuming we award 0.15% of the value of his plan each year and his investments grow by 2.6% each year.

These figures show that over time, ProfitShare could help to increase Harry's pension savings from £208,000 to £215,000. This would give him an extra £7,000.

You should remember that this is only an example and investment returns are never guaranteed. This means that while there's a chance your savings could grow, they could also fall in value. So you could get back less than you started with.

More about ProfitShare

Learn how ProfitShare works and how it could make a difference for you

ProfitShare – Membership of Royal London

This means we don't have shareholders. Instead, we're own by our members, who can have a say on on company decisions by voting at our AGM.